Pennsylvania State Tax Return: A Comprehensive Guide For 2024

Pennsylvania state tax return is an essential aspect of financial responsibility for residents. Whether you're filing for the first time or looking to understand recent changes, having a clear understanding of the process can save you time and money. This guide will walk you through everything you need to know about Pennsylvania's state tax return, ensuring you're well-prepared for the filing season.

Understanding the intricacies of Pennsylvania's tax system is crucial for maximizing your refund or minimizing your liability. The state offers various deductions and credits that can significantly impact your return. By staying informed, you can make the most of these opportunities and ensure compliance with state regulations.

As tax laws evolve, it's important to stay updated with the latest changes. This article will provide detailed insights into Pennsylvania's tax return process, covering everything from deadlines and forms to deductions and credits. Let's dive in and explore how you can navigate this process effectively.

- Pizza Brew Scarsdale

- Shopping Mall Amarillo Tx

- Walt S Pizza Marion Il

- Who Is The Quarterback For Texans

- Sky High Bar Pasig

Table of Contents

- Biography of Pennsylvania Tax System

- Pennsylvania State Tax Filing Deadlines

- Common Pennsylvania Tax Forms

- Eligible Deductions for Pennsylvania Residents

- Tax Credits Available in Pennsylvania

- Types of Income Subject to Pennsylvania Tax

- Filing Methods: Online vs Paper

- Amending Pennsylvania State Tax Returns

- Penalties for Late or Incorrect Filings

- Useful Resources for Pennsylvania Taxpayers

- Conclusion and Next Steps

Biography of Pennsylvania Tax System

Pennsylvania's tax system has a rich history, evolving over the years to meet the needs of its residents. Established to fund essential public services, the state tax structure includes various components such as income tax, sales tax, and property tax. Below is a summary of key aspects of the Pennsylvania tax system:

| Aspect | Details |

|---|---|

| Established | 1941 |

| Tax Rate | 3.07% flat rate for personal income tax |

| Exemptions | No exemptions for income tax; all income is taxed |

| Filing Deadline | April 15th annually |

Historical Development

The Pennsylvania tax system has undergone several changes since its inception. Initially, the focus was primarily on property taxes, but over time, the state introduced income and sales taxes to diversify revenue sources. These changes reflect Pennsylvania's commitment to fair taxation and equitable distribution of resources.

Pennsylvania State Tax Filing Deadlines

Knowing the deadlines for Pennsylvania state tax return is crucial to avoid penalties. The standard deadline for filing your state tax return is April 15th each year. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day.

- Can Doordash Drivers See Tip

- City Of Milwaukee Recycling Pickup

- Carimar Beach Club Hotel Anguilla

- Where Do Pancakes Originate From

- Who Are The Parents Of Thomas Matthew Crooks

Extensions

If you need more time to file, you can request an extension. The extension form, PA-40EXT, must be submitted by the original deadline. Keep in mind that an extension only grants additional time to file, not to pay any taxes owed.

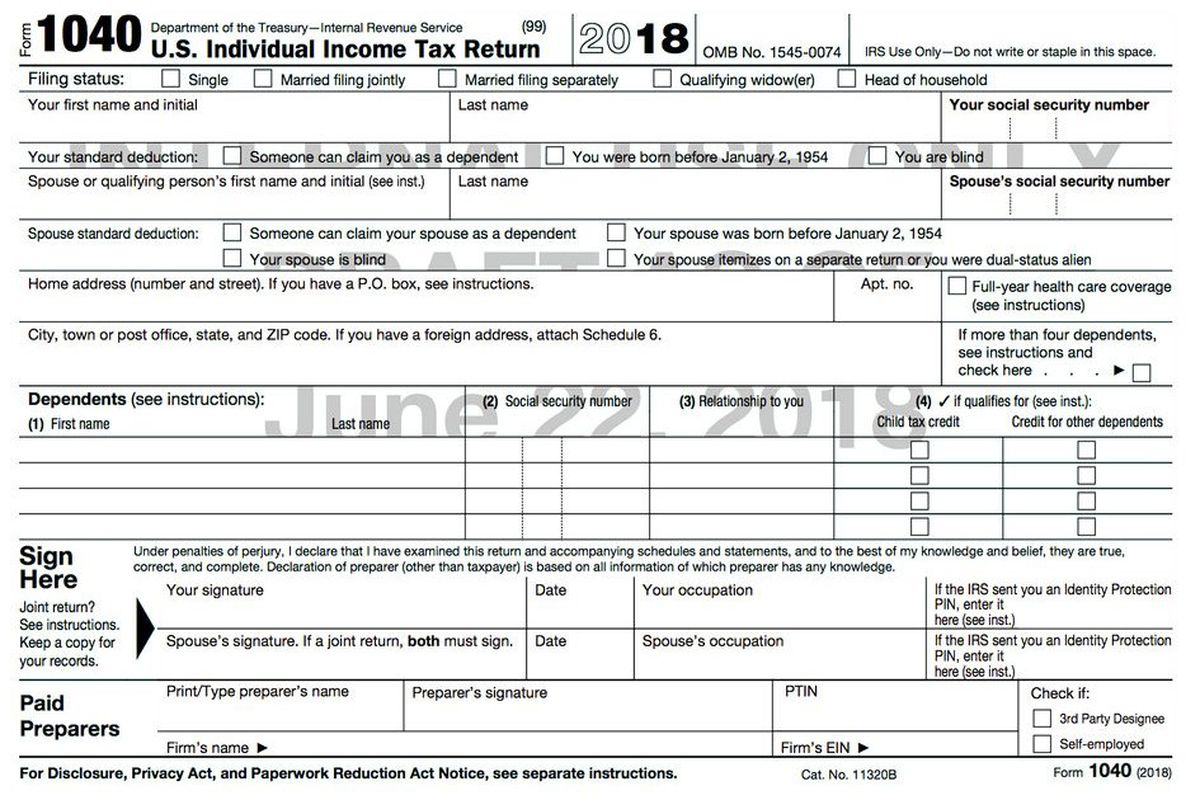

Common Pennsylvania Tax Forms

Familiarizing yourself with the necessary forms is an important step in preparing your Pennsylvania state tax return. Below are some commonly used forms:

- PA-40: Resident and Nonresident Personal Income Tax Return

- PA-40S: Supplemental Schedule for PA-40

- PA-40EXT: Application for Extension of Time to File

- PA-40ES: Estimated Tax Payment Voucher

How to Obtain Forms

You can download these forms from the Pennsylvania Department of Revenue website or request them via mail. Ensure you use the latest versions to avoid errors and delays in processing.

Eligible Deductions for Pennsylvania Residents

Pennsylvania offers several deductions that can reduce your taxable income. While the state does not allow itemized deductions like the federal government, certain expenses may qualify for reduction:

- Contributions to Pennsylvania IRA accounts

- Business expenses for self-employed individuals

- Alimony payments made under agreements executed before December 31, 2018

- Education expenses for Pennsylvania residents

Claiming Deductions

To claim deductions, ensure you have proper documentation and attach any required schedules to your PA-40 form. Accuracy is key to avoiding audits and ensuring you receive the full benefit of available deductions.

Tax Credits Available in Pennsylvania

In addition to deductions, Pennsylvania offers various tax credits to help lower your tax liability. These credits can be claimed directly on your PA-40 form:

- Keystone Childcare Credit

- Elderly Tax Credit

- Property Tax/Rent Rebate Program

- Energy Efficiency Credit

Eligibility Criteria

Each credit has specific eligibility requirements. For instance, the Keystone Childcare Credit is available to families earning up to $30,000 annually, while the Elderly Tax Credit applies to seniors over 65 with limited income. Review the criteria carefully to determine which credits you qualify for.

Types of Income Subject to Pennsylvania Tax

All income earned within Pennsylvania is subject to the state's 3.07% flat tax rate. This includes wages, salaries, tips, and other forms of compensation. Below are some examples of taxable income:

- Wages from employment

- Self-employment income

- Interest and dividends

- Rental income

Exceptions

Some forms of income are exempt from Pennsylvania state tax. These include Social Security benefits, military retirement pay, and certain disability payments. Understanding these exceptions can help you accurately calculate your taxable income.

Filing Methods: Online vs Paper

Pennsylvania residents have the option to file their state tax returns either online or through paper forms. Each method has its advantages:

Online Filing

Online filing through the Pennsylvania Department of Revenue's website offers convenience and speed. You can electronically submit your return and receive confirmation instantly. Additionally, many online platforms offer free filing options for eligible taxpayers.

Paper Filing

For those who prefer traditional methods, paper filing is still available. Ensure you complete all forms accurately and mail them to the appropriate address. Keep copies of all submitted documents for your records.

Amending Pennsylvania State Tax Returns

If you discover errors on your originally filed return, you may need to amend it. Use Form PA-40X to make corrections. Common reasons for amending include:

- Incorrect income reporting

- Missed deductions or credits

- Changes in filing status

Steps to Amend

When amending your return, include all necessary documentation and explain the reason for the change. Amended returns may take longer to process, so submit them as soon as possible to avoid delays in receiving refunds or resolving liabilities.

Penalties for Late or Incorrect Filings

Failing to file or pay your Pennsylvania state taxes on time can result in penalties and interest. The Department of Revenue imposes the following penalties:

- Failure to file penalty: 5% of the tax due per month, up to a maximum of 25%

- Failure to pay penalty: 0.5% of the tax due per month

- Interest: Applied at the current rate, compounded daily

Avoiding Penalties

To avoid penalties, ensure you file and pay your taxes by the deadline. If you're unable to meet the deadline, file for an extension and make estimated payments if necessary. Staying proactive can save you from unnecessary financial burdens.

Useful Resources for Pennsylvania Taxpayers

Several resources are available to assist Pennsylvania residents with their state tax returns:

- Pennsylvania Department of Revenue Website

- Taxpayer Assistance Centers

- Free File Alliance for eligible taxpayers

- Professional tax preparers and accountants

Seeking Professional Help

If you're unsure about any aspect of your tax return, consider consulting a tax professional. They can provide guidance tailored to your specific situation and help ensure compliance with state regulations.

Conclusion and Next Steps

In conclusion, understanding Pennsylvania state tax return is vital for every resident. By following the guidelines outlined in this article, you can navigate the process with confidence. Remember to:

- File your return by the deadline

- Claim all eligible deductions and credits

- Utilize available resources for assistance

- Stay informed about any changes in tax laws

We encourage you to share this article with others who may find it helpful and leave a comment below if you have any questions. Additionally, explore other articles on our site for more valuable insights into personal finance and taxation.

- Beauty And Essex Reviews

- The Wild Robot Gross

- Cast Your Anxiety On The Lord

- Norms Restaurant Huntington Beach Ca

- City Of Milwaukee Recycling Pickup

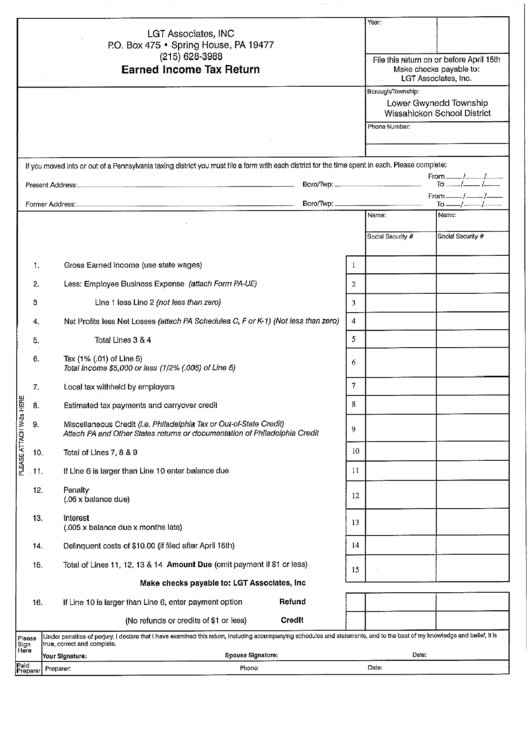

Earned Tax Return State Of Pennsylvania printable pdf download

Printable Pa State Tax Return Forms Printable Forms Free Online

Pennsylvania tax brackets 2021 demofiko