Dave Ramsey On Debt Consolidation Loans: A Comprehensive Guide

Debt consolidation loans have become a popular financial solution for individuals looking to simplify their debt management process. However, financial expert Dave Ramsey offers a unique perspective on this topic, emphasizing the importance of financial discipline and long-term solutions. If you're considering debt consolidation, understanding Ramsey's approach can help you make informed decisions about your financial future.

Managing debt is a challenge that many people face in today's economic climate. Whether it's credit card balances, personal loans, or medical bills, debt can quickly spiral out of control. Debt consolidation loans promise to combine multiple debts into a single payment, often with lower interest rates. While this sounds appealing, Dave Ramsey's philosophy encourages a deeper look into the root causes of debt and the importance of financial education.

This article will explore Dave Ramsey's views on debt consolidation loans, providing valuable insights into his debt management strategies and offering actionable advice for those seeking to regain control of their finances. By the end of this article, you'll have a clear understanding of whether debt consolidation aligns with Ramsey's principles and how you can implement his advice in your financial journey.

- How Do I Watch True Blood

- Viola Agnes Neo Soul Cafe

- Smallest Tank In The World

- Best Dressing For Seafood Salad

- I Came From A Middle Class Family

Table of Contents

- Dave Ramsey: A Brief Biography

- What Are Debt Consolidation Loans?

- Dave Ramsey's Perspective on Debt Consolidation

- Benefits of Debt Consolidation Loans

- Drawbacks of Debt Consolidation Loans

- Dave Ramsey's Recommended Debt Solutions

- Case Studies: Real-Life Examples

- Alternatives to Debt Consolidation

- Expert Advice on Managing Debt

- Conclusion and Call to Action

Dave Ramsey: A Brief Biography

Before diving into his thoughts on debt consolidation loans, let's take a moment to understand who Dave Ramsey is and why his opinions carry significant weight in the financial world.

Early Life and Career

Dave Ramsey was born on September 2, 1960, in Antioch, Tennessee. He gained prominence as a financial expert, author, and radio host. Ramsey's journey into financial education began after a personal financial crisis in the 1980s, where he lost his real estate fortune. This experience fueled his passion for teaching others about financial responsibility and debt management.

| Full Name | Dave Ramsey |

|---|---|

| Birth Date | September 2, 1960 |

| Profession | Financial Expert, Author, Radio Host |

| Notable Works | "The Total Money Makeover," "Financial Peace" |

What Are Debt Consolidation Loans?

Debt consolidation loans are financial products designed to combine multiple debts into a single loan with a fixed interest rate. This approach aims to simplify the repayment process and potentially reduce the overall interest burden. Borrowers often use these loans to pay off high-interest credit card balances, medical bills, or other unsecured debts.

- How Do I Apply Concealer And Foundation

- Agustin De La Casa De Los Famosos

- Spirit Airlines Rat On Plane

- New Castle News Police Reports

- Costco Near Amarillo Tx

How Debt Consolidation Works

Here’s how debt consolidation loans typically work:

- Borrowers apply for a debt consolidation loan from a bank, credit union, or online lender.

- The lender evaluates the borrower's credit score, income, and debt-to-income ratio.

- If approved, the lender issues a lump-sum payment to cover existing debts.

- The borrower repays the consolidation loan over a predetermined period, usually with lower monthly payments.

While this process seems straightforward, Dave Ramsey raises important questions about its effectiveness in addressing the root causes of debt.

Dave Ramsey's Perspective on Debt Consolidation

Dave Ramsey is known for his no-nonsense approach to personal finance. When it comes to debt consolidation loans, Ramsey's stance is clear: he believes they often perpetuate the cycle of debt rather than solving the problem. Instead, he advocates for a more disciplined approach to debt elimination.

Why Ramsey Dislikes Debt Consolidation

Ramsey argues that debt consolidation loans can give borrowers a false sense of financial relief without addressing the underlying behaviors that led to debt accumulation. Here are some reasons why Ramsey advises caution:

- Doesn't Address Spending Habits: Consolidation loans don't tackle the root cause of overspending or financial mismanagement.

- Potential for New Debt: Borrowers may feel inclined to take on new debt after consolidating, leading to a cycle of dependency.

- Interest Rates May Still Be High: While consolidation loans often have lower interest rates than credit cards, they may still carry significant costs over time.

Benefits of Debt Consolidation Loans

Despite Ramsey's concerns, debt consolidation loans do offer some advantages for certain individuals. Let's explore the potential benefits:

Key Advantages

- Simplified Payments: Borrowers only need to manage one monthly payment instead of juggling multiple bills.

- Lower Interest Rates: Consolidation loans often come with lower interest rates compared to credit cards, reducing the total cost of debt.

- Improved Cash Flow: Lower monthly payments can free up cash for other financial priorities.

While these benefits are appealing, it's crucial to weigh them against the potential drawbacks before proceeding with a consolidation loan.

Drawbacks of Debt Consolidation Loans

For all its advantages, debt consolidation loans also come with significant risks. Here are some potential downsides:

Common Challenges

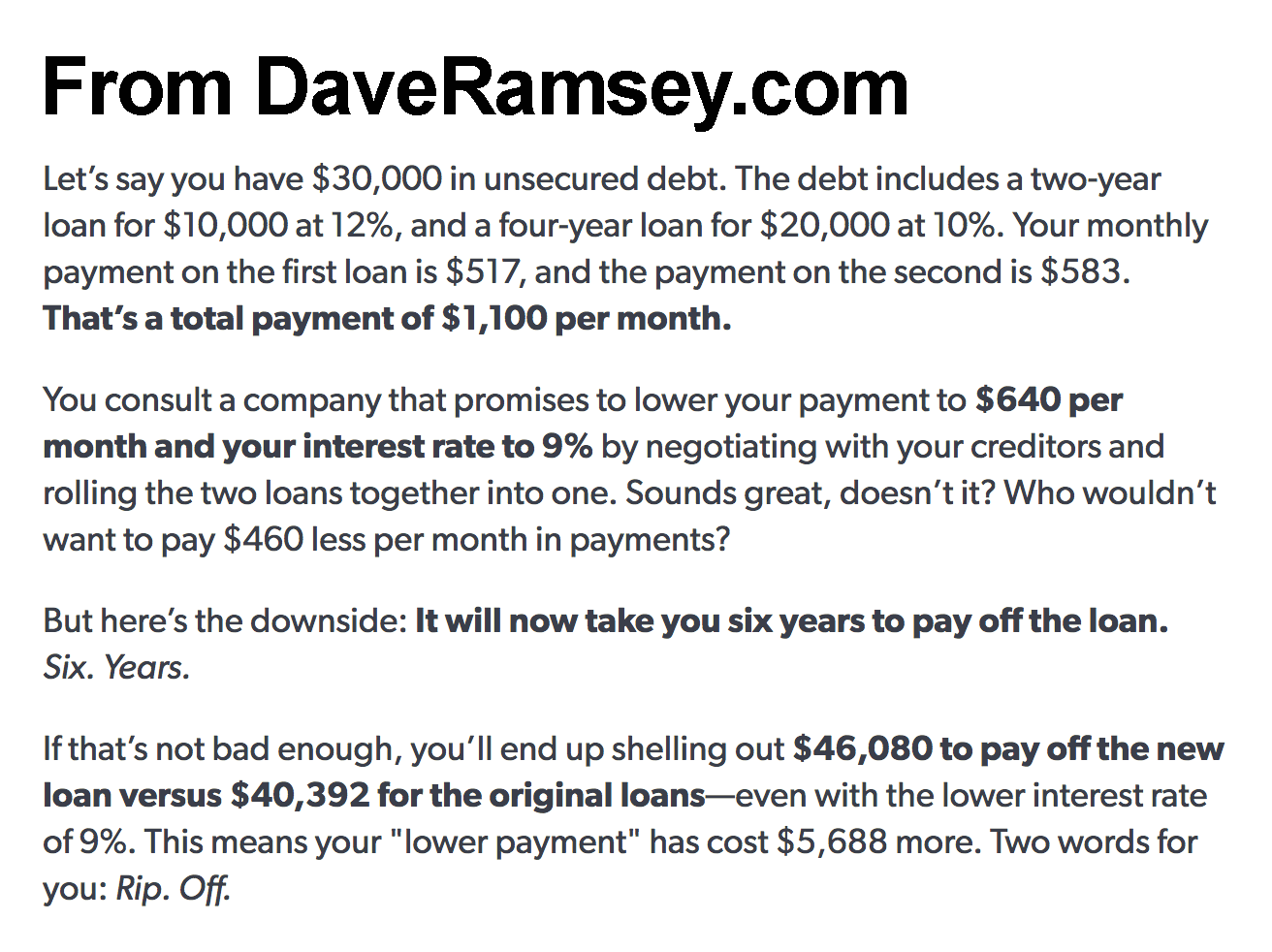

- Longer Repayment Terms: Consolidation loans may extend the repayment period, leading to more interest paid over time.

- Possible Fees: Borrowers may face origination fees, balance transfer fees, or other costs associated with the loan.

- Requires Discipline: Without a change in spending habits, borrowers may end up accumulating more debt after consolidation.

Ramsey emphasizes that financial solutions should empower individuals to break free from debt permanently, not just temporarily.

Dave Ramsey's Recommended Debt Solutions

Rather than relying on debt consolidation loans, Dave Ramsey advocates for a proactive approach to debt elimination. His debt management strategies are centered around discipline, accountability, and financial education.

The Debt Snowball Method

One of Ramsey's most popular methods is the debt snowball approach. This involves paying off debts in order of smallest to largest balance, regardless of interest rates. By focusing on quick wins, borrowers gain momentum and motivation to tackle larger debts.

Steps to Implement the Debt Snowball Method:

- List all debts from smallest to largest.

- Make minimum payments on all debts except the smallest.

- Allocate extra funds toward paying off the smallest debt.

- Once the smallest debt is paid, roll the payment amount into the next smallest debt.

- Repeat the process until all debts are eliminated.

Case Studies: Real-Life Examples

Understanding how Ramsey's principles apply in real-world scenarios can provide valuable insights. Here are two case studies illustrating the effectiveness of his debt management strategies:

Case Study 1: Sarah's Journey to Debt Freedom

Sarah, a single mother from Texas, accumulated $25,000 in credit card debt over several years. By implementing the debt snowball method and cutting unnecessary expenses, she managed to pay off her debt in just 18 months. Sarah credits Ramsey's teachings for her success and now prioritizes saving for emergencies.

Case Study 2: John's Decision Against Consolidation

John, a young professional from Florida, considered a debt consolidation loan to manage his student loans and credit card balances. After researching Ramsey's advice, he decided against consolidation and instead focused on increasing his income and reducing expenses. Within two years, John became debt-free and started building wealth through investments.

Alternatives to Debt Consolidation

For those seeking alternatives to debt consolidation loans, Ramsey suggests exploring other options that promote financial independence. Here are some strategies to consider:

Building an Emergency Fund

Creating an emergency fund is a foundational step in Ramsey's financial plan. By setting aside three to six months' worth of living expenses, individuals can avoid taking on new debt during unexpected situations.

Increasing Income

Finding ways to boost income, such as starting a side hustle or negotiating a raise, can accelerate the debt repayment process. Ramsey encourages creativity and perseverance in pursuing additional income streams.

Expert Advice on Managing Debt

Managing debt effectively requires a combination of knowledge, discipline, and support. Here are some expert tips to help you stay on track:

Key Takeaways

- Stay Educated: Continuously learn about personal finance and debt management strategies.

- Seek Accountability: Share your financial goals with a trusted friend or family member to stay motivated.

- Focus on Long-Term Solutions: Avoid quick fixes that don't address the root causes of debt.

According to a report by the Federal Reserve Bank of New York, consumer debt reached $15.98 trillion in Q2 2023. This statistic underscores the importance of proactive debt management and financial literacy.

Conclusion and Call to Action

In conclusion, while debt consolidation loans offer a potential solution for managing multiple debts, Dave Ramsey's perspective highlights the importance of addressing the root causes of financial challenges. By adopting disciplined strategies like the debt snowball method, building an emergency fund, and increasing income, individuals can achieve lasting financial freedom.

We invite you to take the first step toward financial independence by implementing these strategies in your life. Share your thoughts and experiences in the comments below, and don't forget to explore other articles on our website for additional insights into personal finance and debt management.

- Smallest Tank In The World

- Walt S Pizza Marion Il

- Ross For Less Houston

- Can You Bring Medications On A Plane

- Iris Goo Goo Dolls Cover

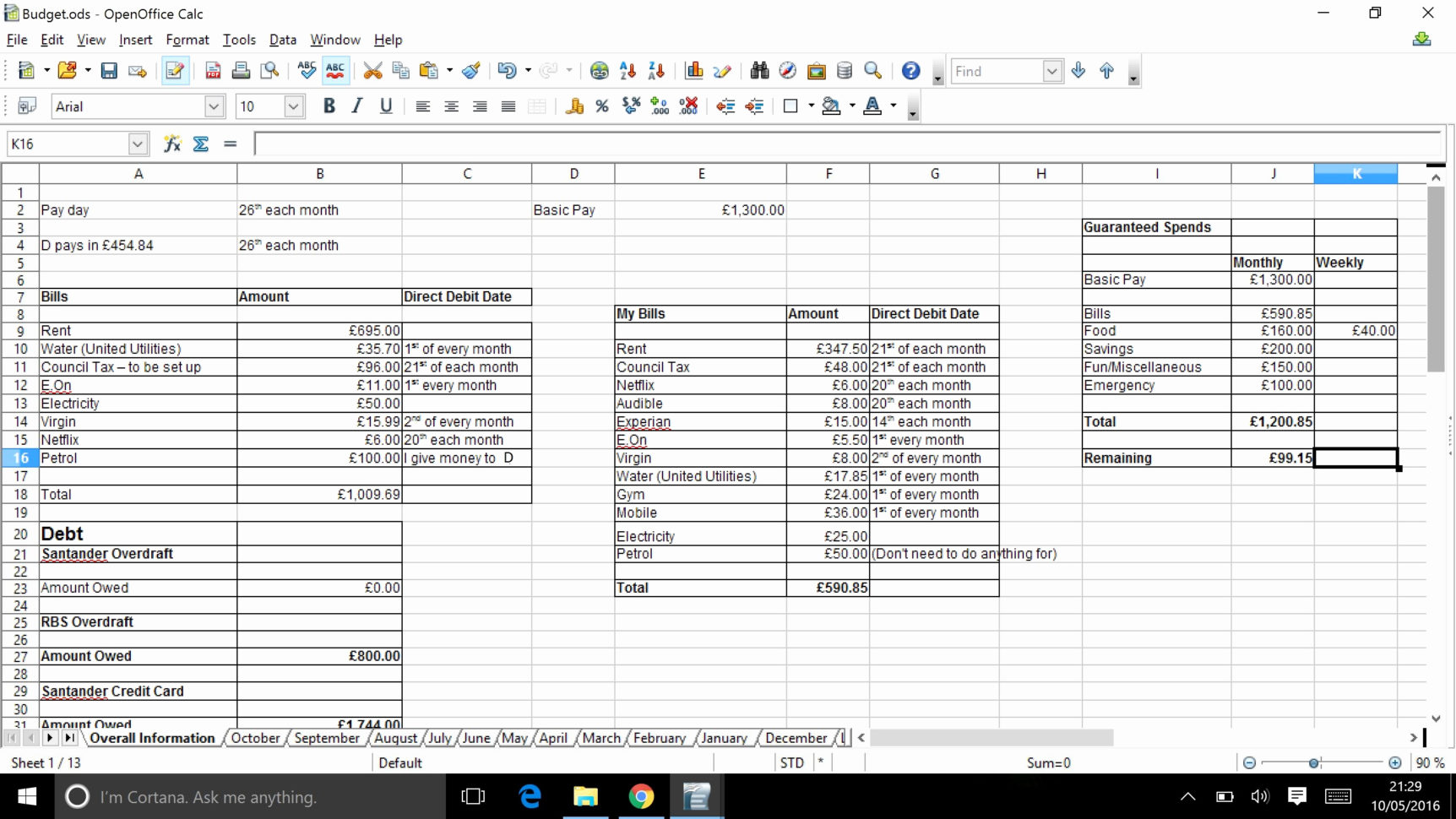

Debt Consolidation Excel Spreadsheet Best Of Dave Ramsey Snowball with

The Truth about Dave Ramsey Bad Math Revealed on

The Truth About Debt Consolidation Ramsey