Comprehensive Guide To Car Insurance Quotes Experian: Everything You Need To Know

When it comes to car insurance quotes Experian, understanding the intricacies of how your credit score impacts your insurance premiums is crucial. Many people overlook the connection between their credit history and auto insurance rates, but Experian offers valuable tools and insights to help you secure the best possible deal. This guide will walk you through the essential steps and factors to consider when obtaining car insurance quotes through Experian, ensuring you make informed decisions.

Car insurance is not just a legal requirement; it's a financial safeguard that protects you from unexpected expenses. However, navigating the world of insurance quotes can be overwhelming. Experian simplifies this process by providing detailed credit reports and analytics that insurers often use to determine your risk profile. By leveraging this information, you can better negotiate your premiums.

In this article, we'll explore the role of Experian in shaping your car insurance quotes, how credit scores influence premiums, and practical tips for securing the best rates. Whether you're a first-time car owner or looking to renew your policy, this guide has everything you need to save money while staying protected.

- Viola Agnes Neo Soul Cafe

- Why Is Russia Not In The Olympics But Israel Is

- What Does Putting An Onion In Your Sock Do

- Wall To Wall New York

- The Wild Robot Gross

Table of Contents

- Introduction to Experian and Its Role in Car Insurance

- How Credit Scores Impact Car Insurance Quotes

- Experian Tools for Analyzing Insurance Quotes

- Factors Affecting Car Insurance Quotes Experian

- Steps to Obtain Car Insurance Quotes Using Experian

- Long-Tail Keywords and Their Importance

- Data and Statistics on Car Insurance Rates

- Tips for Saving Money on Car Insurance

- Comparison Tools for Car Insurance Quotes

- Conclusion and Call to Action

Introduction to Experian and Its Role in Car Insurance

Experian is one of the three major credit reporting agencies in the United States, alongside Equifax and TransUnion. It plays a significant role in the financial ecosystem by collecting and analyzing consumer credit information. When it comes to car insurance quotes Experian, the company provides detailed credit reports that insurers use to assess risk and set premiums.

Insurance companies often rely on credit-based insurance scores to determine how likely a policyholder is to file a claim. Experian's credit data helps insurers create a more accurate picture of your financial responsibility, which directly impacts the cost of your car insurance. By understanding how Experian works, you can take steps to improve your credit score and, in turn, reduce your insurance premiums.

Understanding Experian's Credit Reporting

Experian's credit reports include information such as payment history, credit utilization, and outstanding debts. These factors are critical in calculating your credit score, which insurers use to evaluate your risk profile. A higher credit score typically results in lower car insurance quotes, as it indicates financial stability and responsibility.

- Who Are The Parents Of Thomas Matthew Crooks

- Carimar Beach Club Hotel Anguilla

- Shadow Box With Photos

- Weston Elementary Ripon Ca

- Spirit Airlines Rat On Plane

How Credit Scores Impact Car Insurance Quotes

Your credit score is one of the most significant factors influencing car insurance quotes Experian. Studies have shown that individuals with higher credit scores tend to file fewer claims, making them less risky to insure. As a result, insurers often offer lower premiums to those with excellent credit scores.

Here are some key ways credit scores affect your car insurance rates:

- Higher credit scores correlate with lower premiums.

- Insurers use credit-based insurance scores to assess risk.

- Improving your credit score can lead to significant savings on car insurance.

Factors That Influence Credit Scores

Several factors contribute to your credit score, including:

- Payment history (35%)

- Credit utilization (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit inquiries (10%)

Experian Tools for Analyzing Insurance Quotes

Experian offers a variety of tools to help consumers understand and improve their credit scores. These tools can be invaluable when obtaining car insurance quotes Experian. By leveraging Experian's resources, you can gain insights into your credit profile and negotiate better rates with insurers.

Key Tools to Consider

Some of Experian's most useful tools for analyzing car insurance quotes include:

- Credit Score Tracker: Monitor changes in your credit score over time.

- Credit Report Access: Review your full credit report for errors or discrepancies.

- Simulate Credit Changes: See how different financial decisions impact your credit score.

Factors Affecting Car Insurance Quotes Experian

In addition to credit scores, several other factors influence car insurance quotes Experian. These include:

- Driving history

- Vehicle type

- Age and gender

- Location

- Annual mileage

Understanding these factors can help you identify areas where you can potentially reduce your premiums. For example, maintaining a clean driving record and choosing a vehicle with a lower risk profile can lead to significant savings.

Driving History and Its Impact

Your driving history is a critical component of car insurance quotes Experian. Insurers consider factors such as accidents, traffic violations, and claims history when determining your premiums. A clean driving record often results in lower rates, so it's essential to drive responsibly and avoid infractions.

Steps to Obtain Car Insurance Quotes Using Experian

Obtaining car insurance quotes Experian involves a few key steps:

- Review your credit report for accuracy and completeness.

- Identify areas for improvement in your credit score.

- Compare quotes from multiple insurers to find the best deal.

- Provide accurate information about your driving history and vehicle.

- Negotiate premiums based on your credit profile and risk factors.

Why Compare Quotes?

Comparing quotes from multiple insurers is crucial for securing the best possible rate. Each company uses different algorithms and criteria to calculate premiums, so shopping around can save you hundreds of dollars annually. Experian's tools can help you make informed decisions when comparing quotes.

Long-Tail Keywords and Their Importance

Long-tail keywords are specific phrases that target niche audiences. In the context of car insurance quotes Experian, examples of long-tail keywords include "Experian credit score impact on car insurance" and "how to improve car insurance quotes with Experian." Using these keywords in your search can yield more relevant and targeted results.

Benefits of Long-Tail Keywords

Using long-tail keywords offers several advantages:

- Increased relevance and specificity in search results.

- Lower competition for high-volume keywords.

- Improved chances of ranking higher in search engine results.

Data and Statistics on Car Insurance Rates

According to recent studies, drivers with excellent credit scores pay an average of 25% less for car insurance than those with poor credit scores. Additionally, younger drivers and those in urban areas tend to face higher premiums due to increased risk factors. These statistics highlight the importance of maintaining a strong credit profile when seeking car insurance quotes Experian.

Key Statistics to Note

- Drivers with excellent credit scores save up to $600 annually on car insurance.

- Urban drivers pay approximately 15% more than rural drivers for car insurance.

- Men under 25 typically pay higher premiums than women in the same age group.

Tips for Saving Money on Car Insurance

Saving money on car insurance quotes Experian requires a combination of strategies:

- Improve your credit score by paying bills on time and reducing debt.

- Bundle policies with the same insurer for discounts.

- Consider increasing your deductible to lower premiums.

- Take advantage of safe driver discounts and other incentives.

Discounts to Look For

Many insurers offer discounts for:

- Safe driving records

- Multiple vehicles insured

- Home and auto policy bundles

- Low annual mileage

Comparison Tools for Car Insurance Quotes

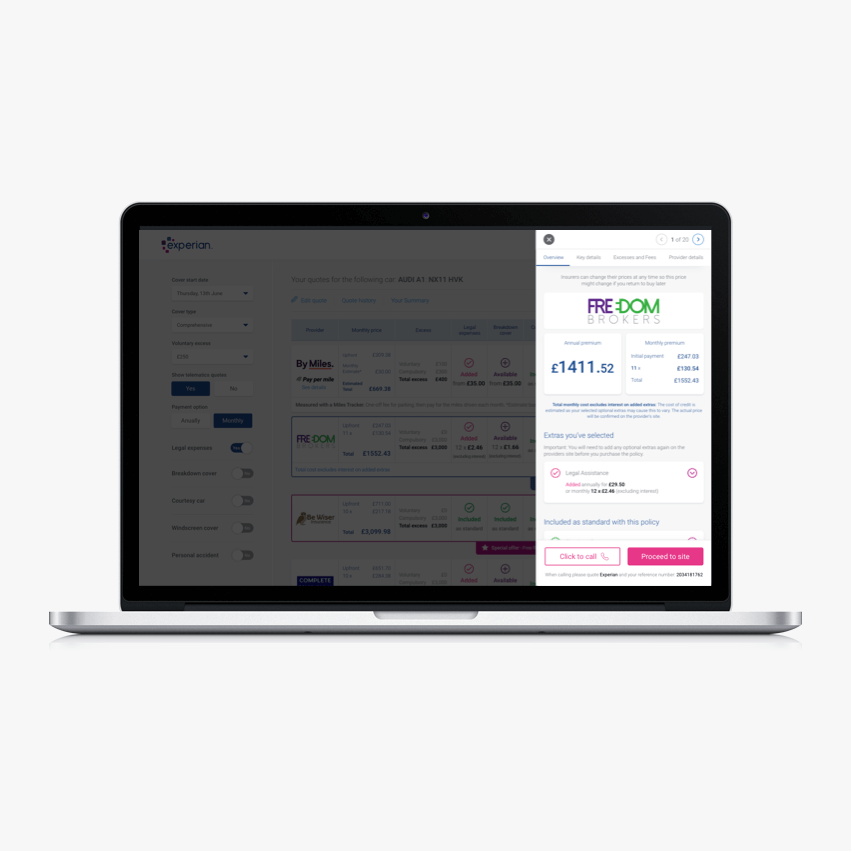

Several online platforms offer comparison tools to help you find the best car insurance quotes Experian. These tools allow you to input your information once and receive multiple quotes from different insurers. Some popular comparison tools include:

- Experian CreditMatch

- Policygenius

- The Zebra

Why Use Comparison Tools?

Comparison tools save time and effort by streamlining the quote-gathering process. They also provide a side-by-side view of different policies, making it easier to identify the best value for your needs.

Conclusion and Call to Action

In conclusion, understanding car insurance quotes Experian and the role of credit scores in determining premiums is essential for saving money on coverage. By leveraging Experian's tools and resources, you can improve your credit profile and secure better rates from insurers. Remember to compare quotes from multiple providers and take advantage of available discounts to maximize your savings.

We invite you to share your thoughts and experiences in the comments below. Have you used Experian to obtain car insurance quotes? What strategies have worked best for you? Don't forget to explore our other articles for more tips and insights on personal finance and insurance.

- New York City Police Department 94th Precinct

- How Do I Watch True Blood

- Cast Your Anxiety On The Lord

- Can You Bring Medications On A Plane

- Sonic Drive In Frisco Tx

Are Car Insurance Photo Estimates Accurate? Experian

Experian Car Insurance James Kember

Experian Insurance Broker Review 2025