Washington County Oregon Property Tax Statement: A Comprehensive Guide

Property taxes play a critical role in the financial structure of Washington County, Oregon. Understanding how property tax statements work is essential for homeowners, investors, and anyone involved in real estate in this region. This article delves into the intricacies of Washington County's property tax system, ensuring you are well-informed about your obligations and rights as a property owner.

Whether you're new to the area or a long-time resident, navigating property tax statements in Washington County can be challenging. From understanding the assessment process to knowing how taxes are calculated, this guide provides clarity and actionable insights. We aim to simplify complex concepts so that you can make informed decisions.

This article will cover everything from the basics of property tax statements to advanced strategies for managing your tax liabilities. By the end, you'll have a comprehensive understanding of Washington County Oregon property tax statements and how they affect you.

- Bahama House Daytona Shores

- Miller Welding Machines For Sale

- The Ups Store Amherst

- Photos Of Mercedes Benz Stadium In Atlanta

- Lilly Sabri Free Workout Plan

Table of Contents

- Introduction to Property Tax in Washington County

- Understanding Property Tax Statements

- The Property Tax Assessment Process

- Calculating Property Taxes

- Key Components of a Tax Statement

- Payment Options and Deadlines

- Exemptions and Relief Programs

- Challenges and Common Issues

- Resources for Property Owners

- Conclusion and Next Steps

Introduction to Property Tax in Washington County

Property taxes in Washington County, Oregon, are a significant source of revenue for local governments. These funds are used to finance public services such as schools, emergency services, parks, and infrastructure improvements. Understanding the basics of property tax is crucial for anyone who owns or plans to own property in this area.

Washington County follows a structured system for assessing and collecting property taxes. This system ensures that property owners contribute fairly to the community's needs while protecting their rights. The county uses a combination of market value assessments and tax rates to determine the amount owed by each property owner.

Why Property Tax Matters

Property taxes are not just a financial obligation; they are an investment in the community. The revenue generated from property taxes funds essential services that enhance the quality of life for residents. By paying your property taxes on time, you contribute to the development and maintenance of public amenities.

- When Was Steven Tyler Born

- Shopping Mall Amarillo Tx

- Crosby Tx Atv Park

- Ustaad G76 Indian Cuisine

- How Do I Watch True Blood

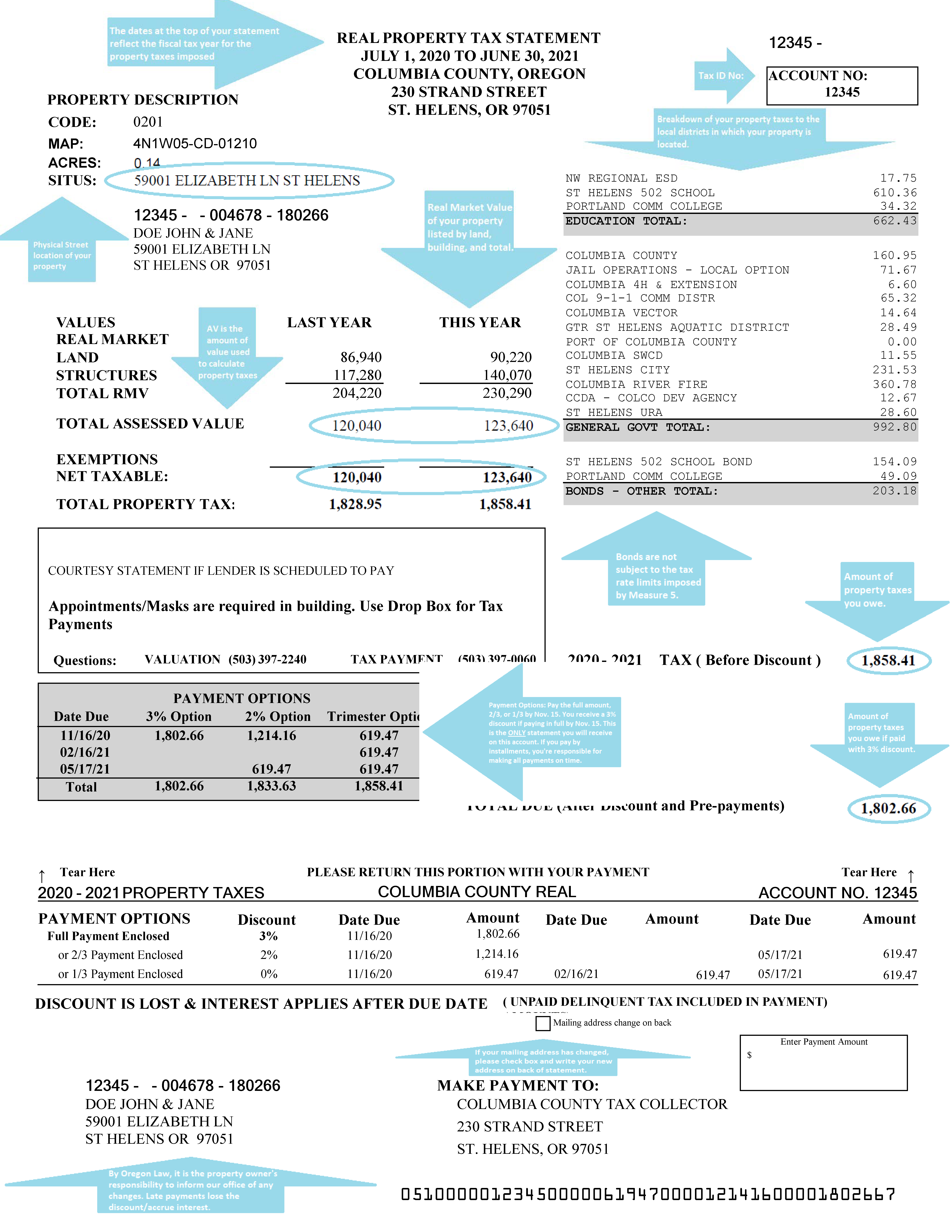

Understanding Property Tax Statements

A property tax statement provides detailed information about the taxes owed on a specific property. In Washington County, these statements include essential details such as property value, assessed value, tax rate, and payment deadlines. Understanding each component of the statement is vital for managing your tax liabilities effectively.

Components of a Tax Statement

- Property Value: The estimated market value of your property.

- Assessed Value: The value used to calculate property taxes, typically a percentage of the market value.

- Tax Rate: The rate applied to the assessed value to determine the tax amount.

- Payment Deadlines: The dates by which payments must be made to avoid penalties.

The Property Tax Assessment Process

The assessment process in Washington County involves evaluating the market value of properties annually. Assessors consider factors such as location, size, condition, and recent sales of similar properties in the area. This evaluation ensures that property values are updated regularly and accurately.

How Assessments Are Conducted

Assessments are conducted by trained professionals who use a combination of data analysis and physical inspections. Property owners can request a reassessment if they believe their property has been overvalued. This process helps maintain fairness and transparency in the tax system.

Calculating Property Taxes

Calculating property taxes involves multiplying the assessed value of a property by the applicable tax rate. For example, if a property has an assessed value of $200,000 and the tax rate is 1.5%, the tax owed would be $3,000. Understanding this calculation can help property owners budget for their tax payments.

Factors Affecting Tax Calculation

Several factors can influence the amount of property tax owed, including:

- Changes in property value

- Adjustments in tax rates

- Exemptions or relief programs

Key Components of a Tax Statement

A detailed tax statement includes various components that provide insights into the tax calculation process. These components help property owners understand how their taxes are determined and what they are paying for.

Breakdown of Tax Statement

- Property Description: Details about the property, including address and legal description.

- Assessment Details: Information on the assessed value and any exemptions applied.

- Tax Calculation: Step-by-step breakdown of how the tax amount is calculated.

Payment Options and Deadlines

Washington County offers multiple payment options for property tax statements, including online payments, mail-in checks, and in-person payments at the county treasurer's office. Property owners should be aware of payment deadlines to avoid penalties or interest charges.

Important Payment Tips

- Pay attention to deadlines and plan ahead to avoid late fees.

- Consider enrolling in automatic payment plans for convenience.

- Keep records of all payments for future reference.

Exemptions and Relief Programs

Washington County offers several exemptions and relief programs to help property owners manage their tax burdens. These programs are designed to assist specific groups, such as senior citizens, disabled individuals, and low-income households.

Eligibility for Exemptions

To qualify for exemptions or relief programs, property owners must meet specific criteria. Applications typically require documentation of income, age, or disability status. It's essential to apply early to ensure timely processing.

Challenges and Common Issues

Property owners in Washington County may face challenges such as disputes over assessed values, missed payment deadlines, or confusion about tax calculations. Addressing these issues promptly is crucial to avoid complications.

Resolving Disputes

If you believe your property has been overvalued, you can file an appeal with the county assessor's office. The appeals process involves submitting evidence to support your claim and attending a hearing if necessary. Understanding the process can help you navigate disputes effectively.

Resources for Property Owners

Washington County provides several resources to assist property owners in understanding and managing their tax obligations. These resources include online portals, contact information for county offices, and educational materials.

Useful Links and Contacts

- Washington County Assessor's Office: [Official Website](https://www.co.washington.or.us/assessor)

- Treasurer's Office: [Official Website](https://www.co.washington.or.us/treasurer)

Conclusion and Next Steps

In conclusion, understanding Washington County Oregon property tax statements is essential for managing your financial responsibilities as a property owner. By familiarizing yourself with the assessment process, calculating taxes, and utilizing available resources, you can ensure compliance and take advantage of available exemptions.

We encourage you to explore the resources provided by Washington County and stay informed about changes in property tax laws. If you found this article helpful, please share it with others and explore our other content for more insights into property ownership and taxation.

Call to Action: Leave a comment below with any questions or insights about property taxes in Washington County. Your feedback helps us improve and provide better resources for our readers.

- City Of Milwaukee Recycling Pickup

- Cast Your Anxiety On The Lord

- I Got Scammed On Facebook Marketplace What Can I Do

- You Don T Know What You Don T Know Quote

- Who Are The Parents Of Thomas Matthew Crooks

Columbia County, Oregon Official Website Understanding your Property

.png)

Columbia County, Oregon Official Website Understanding your Property

Benton County, Oregon Property Tax Tutorial The Corvallis Advocate