How Long Does TurboTax Advance Take? A Comprehensive Guide

Are you wondering how long it takes for TurboTax Advance to process your refund? TurboTax is one of the most popular tax preparation software platforms in the United States, offering a range of features designed to make filing taxes easier and faster. TurboTax Advance, specifically, is a service that allows taxpayers to access their refunds early. In this article, we'll delve into the details of TurboTax Advance and provide you with all the information you need to know.

Taxes can be a daunting task, but TurboTax has made it simpler by introducing TurboTax Advance. This service is particularly beneficial for individuals who need quick access to their refunds. Understanding how long TurboTax Advance takes is crucial for those who rely on their refunds for financial stability.

In this article, we will explore the timeline of TurboTax Advance, factors that influence processing times, and tips to ensure a smooth and efficient refund process. Whether you're a first-time user or a seasoned taxpayer, this guide will help you navigate TurboTax Advance with confidence.

- Photos Of Mercedes Benz Stadium In Atlanta

- Peliculas De Anime En Netflix

- Scrap Yard Philadelphia Pa

- What Was Weezer S First Album

- Www Saudi Arabian Airlines

Understanding TurboTax Advance

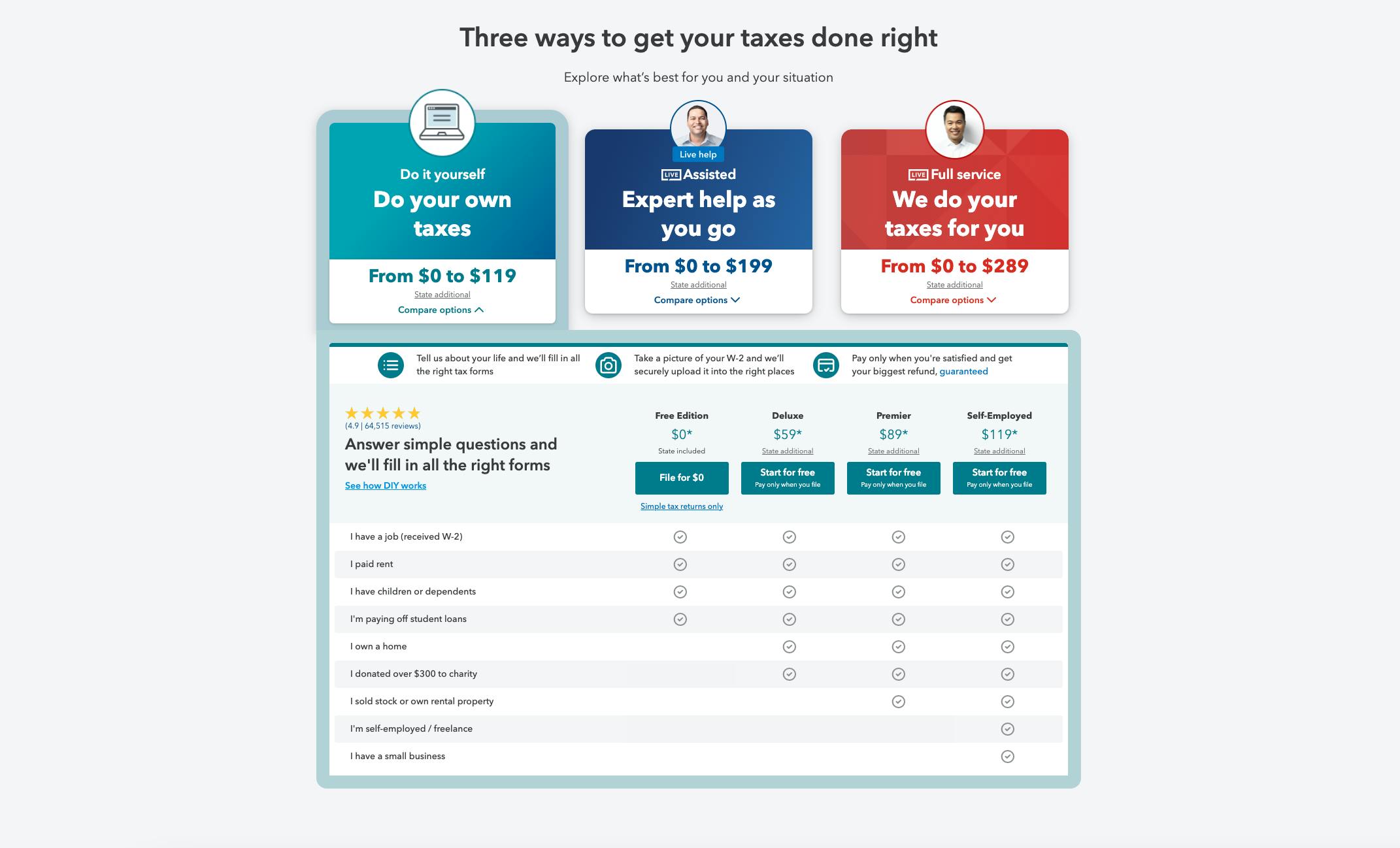

TurboTax Advance is a service that allows taxpayers to receive their refunds early. Instead of waiting for the IRS to process and send the refund, TurboTax partners with financial institutions to provide early access to funds. This service is particularly appealing to individuals who need their refunds quickly.

What is TurboTax Advance?

TurboTax Advance is essentially a short-term loan that is repaid once the IRS processes and deposits the actual refund. The amount of the refund is determined by the tax return filed through TurboTax. Users can choose to have the funds deposited into their bank account or receive them via a prepaid card.

How Does TurboTax Advance Work?

The process begins when you file your tax return using TurboTax software. Once the return is submitted, TurboTax evaluates your eligibility for the Advance service. If approved, the funds are typically available within 1-3 business days. However, this timeline can vary based on several factors.

- Can Doordash Drivers See Tip

- When Was Steven Tyler Born

- Lilly Sabri Free Workout Plan

- Wildflower Resort New York

- Norms Restaurant Huntington Beach Ca

How Long Does TurboTax Advance Take?

The time it takes for TurboTax Advance to process your refund can vary depending on several factors. On average, users can expect to receive their funds within 1-3 business days after their tax return is accepted by the IRS. However, it's important to note that this timeline can be influenced by various elements.

Factors That Affect Processing Times

- IRS Processing Time: The IRS typically takes 21 days to process a tax return. However, this can be shorter or longer depending on the complexity of the return.

- Bank Processing Time: Once the IRS processes the refund, it takes additional time for the funds to reach your bank account. This can vary depending on your financial institution.

- TurboTax Partner Processing: TurboTax partners with financial institutions to facilitate the Advance service. The time it takes for these partners to process the funds can also affect the timeline.

Eligibility for TurboTax Advance

Not everyone qualifies for TurboTax Advance. There are specific criteria that must be met to be eligible for this service. Understanding these requirements can help you determine if TurboTax Advance is right for you.

Who Can Use TurboTax Advance?

TurboTax Advance is available to individuals who file their taxes electronically and meet certain income requirements. Typically, users with a refund of $1,000 or more are eligible. However, this can vary based on the complexity of the tax return and other factors.

Requirements for TurboTax Advance

- File your taxes electronically through TurboTax.

- Have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

- Meet the income requirements set by TurboTax and its partners.

Benefits of TurboTax Advance

TurboTax Advance offers several advantages for taxpayers who need quick access to their refunds. Understanding these benefits can help you make an informed decision about whether to use this service.

Why Choose TurboTax Advance?

- Early Access to Funds: TurboTax Advance allows you to access your refund earlier than waiting for the IRS to process it.

- Convenience: The process is seamless and integrated directly into the TurboTax software, making it easy to apply for the service.

- No Fees: TurboTax Advance does not charge any fees for its service, making it an attractive option for taxpayers.

Potential Downsides of TurboTax Advance

While TurboTax Advance offers many benefits, there are some potential downsides to consider. Understanding these limitations can help you weigh the pros and cons of using this service.

What Are the Drawbacks?

- Refund Reduction: TurboTax Advance may reduce the amount of your refund due to fees charged by financial institutions.

- Approval Not Guaranteed: Not all users are approved for TurboTax Advance, and the decision is based on several factors.

- Processing Delays: In some cases, processing times may be longer than expected due to unforeseen circumstances.

Steps to Apply for TurboTax Advance

Applying for TurboTax Advance is a straightforward process. Follow these steps to ensure a smooth application:

How to Apply for TurboTax Advance

- Complete your tax return using TurboTax software.

- Submit your return electronically through TurboTax.

- During the filing process, TurboTax will evaluate your eligibility for TurboTax Advance.

- If approved, choose how you want to receive your funds (bank account or prepaid card).

Common Questions About TurboTax Advance

Many users have questions about TurboTax Advance. Here are some of the most frequently asked questions:

FAQs About TurboTax Advance

- Can I use TurboTax Advance if I owe taxes? No, TurboTax Advance is only available to individuals who are receiving a refund.

- How much does TurboTax Advance cost? TurboTax Advance does not charge any fees, but financial institutions may charge fees for their services.

- What happens if my refund is less than expected? If your refund is less than the amount advanced, you may be responsible for repaying the difference.

How to Ensure a Smooth Refund Process

There are several steps you can take to ensure a smooth refund process when using TurboTax Advance:

Tips for a Successful TurboTax Advance Experience

- Double-check your tax return for accuracy to avoid delays.

- Ensure your bank account information is correct for direct deposit.

- Monitor the status of your refund through TurboTax's tracking tools.

Conclusion

In conclusion, TurboTax Advance is a valuable service for taxpayers who need quick access to their refunds. By understanding how long TurboTax Advance takes and the factors that influence processing times, you can make an informed decision about using this service. Remember to carefully review the terms and conditions and ensure you meet all eligibility requirements.

We encourage you to share your experiences with TurboTax Advance in the comments below. Your feedback can help others make better-informed decisions. Additionally, feel free to explore other articles on our site for more information on tax preparation and financial planning.

Table of Contents

- Understanding TurboTax Advance

- How Long Does TurboTax Advance Take?

- Eligibility for TurboTax Advance

- Benefits of TurboTax Advance

- Potential Downsides of TurboTax Advance

- Steps to Apply for TurboTax Advance

- Common Questions About TurboTax Advance

- How to Ensure a Smooth Refund Process

- Conclusion

Sources:

- Wall To Wall New York

- When Was Steven Tyler Born

- City Of Milwaukee Recycling Pickup

- City Of Bpt Ct

- When Is Jenni Rivera S Birthday

When Does Turbotax Advance Start 2024 Niki Teddie

When Does Turbotax Advance Start 2024 Niki Teddie

Turbotax Advance 2024 Leora Genevieve