California Dream For All: Unlocking Opportunities With Shared Appreciation Loans

California dream for all shared appreciation loans offers a unique solution for homebuyers who want to achieve their dream of homeownership without breaking the bank. In today's competitive real estate market, securing affordable financing can be a challenge. However, shared appreciation loans provide a viable option that allows borrowers to benefit from property value increases while reducing upfront costs.

As the cost of living and housing prices continue to rise in California, many aspiring homeowners are turning to innovative financial products like shared appreciation loans. These loans are designed to make homeownership more accessible by allowing borrowers to share a portion of their home's future appreciation with an investor or lender.

In this comprehensive guide, we will explore everything you need to know about shared appreciation loans in California, including how they work, their benefits, potential drawbacks, and how you can leverage them to achieve your dream of owning a home. Whether you're a first-time buyer or looking to upgrade your property, this article will provide you with valuable insights to help you make informed decisions.

- Crosby Tx Atv Park

- What Denomination Is The National Cathedral

- I Came From A Middle Class Family

- Lilly Sabri Free Workout Plan

- Miller Welding Machines For Sale

Table of Contents

- What is a Shared Appreciation Loan?

- How Shared Appreciation Loans Work

- Benefits of Shared Appreciation Loans

- Potential Drawbacks

- Shared Appreciation Loans in California

- Eligibility Requirements

- Calculating Equity Sharing

- Comparison with Other Loan Options

- Tips for Choosing the Right Shared Appreciation Loan

- Future Potential of Shared Appreciation Loans

What is a Shared Appreciation Loan?

A shared appreciation loan is a type of financial arrangement where the lender or investor provides funds to the borrower to purchase a property. In return, the borrower agrees to share a predetermined percentage of the property's future appreciation with the lender. This innovative approach allows borrowers to access lower interest rates and reduced upfront costs while still benefiting from property value growth.

Unlike traditional mortgages, shared appreciation loans do not require borrowers to pay back the full principal amount immediately. Instead, the lender's return comes from the shared appreciation at the time of sale or refinancing. This structure makes it an attractive option for those who want to reduce their initial financial burden while investing in real estate.

How Shared Appreciation Loans Work

Understanding how shared appreciation loans work is crucial for anyone considering this option. Here's a breakdown of the key components:

- Walt Disney World Aurora

- Facebook Marketplace People Asking For Phone Number

- Where Do Pancakes Originate From

- Smallest Tank In The World

- The Wild Robot Gross

Loan Structure

These loans typically involve two parties: the borrower and the investor or lender. The borrower receives funding to purchase a property, while the investor receives a share of the property's appreciation when it is sold or refinanced.

Equity Sharing

The equity-sharing agreement specifies the percentage of property appreciation that will be shared with the lender. This percentage is agreed upon during the loan origination process and is usually between 25% to 50% of the property's value increase.

Repayment Terms

Repayment terms vary depending on the lender and the specific loan agreement. In most cases, borrowers are required to repay the loan when they sell the property, refinance, or after a predetermined period, such as 10 or 20 years.

Benefits of Shared Appreciation Loans

Shared appreciation loans offer several advantages for homebuyers:

- Reduced Down Payment: Borrowers can secure a home with a smaller down payment compared to traditional mortgages.

- Lower Monthly Payments: Since the loan is structured differently, borrowers may enjoy lower monthly payments initially.

- Flexibility: These loans provide flexibility in terms of repayment and equity sharing, making them suitable for a wide range of buyers.

- Increased Affordability: By sharing future appreciation, borrowers can afford homes in more desirable locations or with higher price tags.

Potential Drawbacks

While shared appreciation loans offer numerous benefits, they also come with some potential drawbacks:

- Shared Appreciation Risk: Borrowers must share a portion of their property's future appreciation, which could reduce their overall profit.

- Complex Agreements: The terms and conditions of these loans can be complex, requiring careful review and understanding.

- Market Fluctuations: If property values decrease, borrowers may still be obligated to repay the agreed-upon percentage, even if the property loses value.

Shared Appreciation Loans in California

California's booming real estate market makes shared appreciation loans an increasingly popular option for homebuyers. With skyrocketing housing prices, many Californians are turning to these loans to make homeownership more attainable.

California Dream for All

The concept of "California dream for all" emphasizes inclusivity and accessibility in the housing market. Shared appreciation loans align perfectly with this vision by offering a pathway to homeownership for individuals and families who might otherwise struggle to afford a home in California's competitive market.

Eligibility Requirements

To qualify for a shared appreciation loan, borrowers must meet specific eligibility criteria. These may include:

- Credit Score: A minimum credit score is usually required, though some lenders may offer flexible terms for borrowers with lower scores.

- Income Verification: Borrowers must demonstrate stable income and the ability to make monthly payments.

- Property Eligibility: The property being purchased must meet certain criteria, such as location and type.

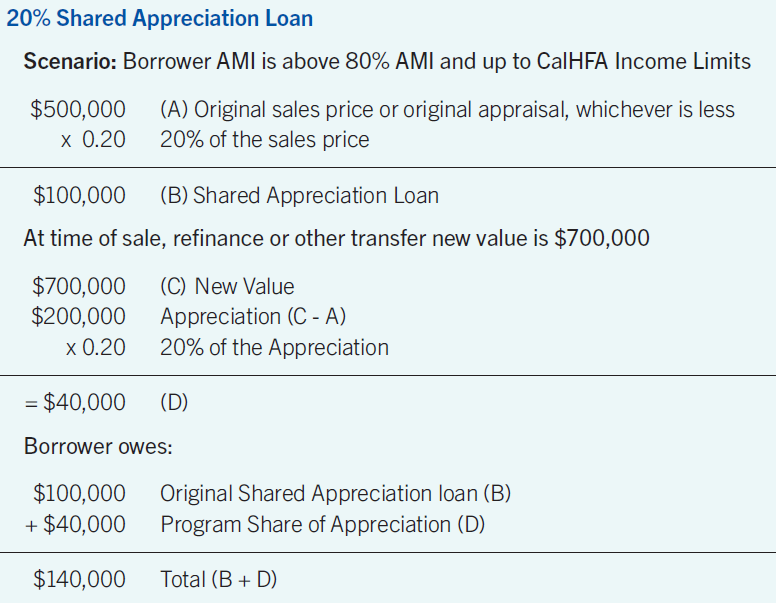

Calculating Equity Sharing

Equity sharing calculations are a critical aspect of shared appreciation loans. Borrowers should work closely with their lender to determine the exact percentage of appreciation that will be shared. For example, if a property's value increases by $100,000 and the agreed-upon sharing percentage is 30%, the borrower would owe the lender $30,000 upon sale or refinancing.

Comparison with Other Loan Options

When evaluating shared appreciation loans, it's essential to compare them with other financing options:

Traditional Mortgages

Traditional mortgages require larger down payments and higher monthly payments but offer full ownership of the property's appreciation.

FHA Loans

FHA loans provide low down payment options but often come with additional fees and insurance requirements.

VA Loans

VA loans are available to eligible veterans and offer competitive terms, but they do not involve equity sharing.

Tips for Choosing the Right Shared Appreciation Loan

When selecting a shared appreciation loan, consider the following tips:

- Research multiple lenders to compare terms and conditions.

- Ensure you fully understand the equity-sharing agreement and repayment terms.

- Work with a reputable financial advisor to evaluate your options.

Future Potential of Shared Appreciation Loans

The future of shared appreciation loans looks promising as more people seek innovative solutions to homeownership challenges. With increasing housing costs and evolving market dynamics, these loans are likely to become even more popular in the coming years.

As technology advances, we may see improved platforms and tools to simplify the shared appreciation loan process, making it easier for borrowers to access and manage their loans.

Conclusion

Shared appreciation loans offer a unique and innovative approach to achieving the California dream of homeownership. By understanding how these loans work, their benefits, and potential drawbacks, you can make an informed decision about whether this option is right for you.

We encourage you to explore shared appreciation loans further and consult with a financial professional to determine the best course of action for your specific situation. Don't forget to share this article with others who might benefit from the information and leave a comment below with your thoughts or questions.

For more insights into real estate and financial topics, explore our other articles on our website.

Data and statistics referenced in this article are sourced from reputable organizations such as the National Association of Realtors and the Federal Reserve. Always verify information with trusted sources before making financial decisions.

- Sky High Bar Pasig

- New York City Police Department 94th Precinct

- Easy Diy Macrame Wall Hanging

- Photos Of Mercedes Benz Stadium In Atlanta

- The Vic Theater Capacity

Power 1 Financial

20+ Annualized Returns Secured by Real Estate — A Remodeled Home

Understanding the California Dream For All Shared Appreciation Loan