Comprehensive Guide To Florida Blue Cross Blue Shield Coverage

Florida Blue Cross Blue Shield coverage is one of the most sought-after health insurance options in the state, offering a wide range of benefits and flexibility to its members. Whether you're a resident looking for affordable healthcare plans or someone exploring your options for the first time, understanding how this coverage works is essential. In this article, we'll delve into everything you need to know about Florida Blue Cross Blue Shield, including its benefits, coverage options, and how to choose the best plan for you.

Health insurance can be complex, but with the right guidance, you can make informed decisions that align with your needs and budget. Florida Blue Cross Blue Shield stands out as a trusted provider, boasting a long history of serving Floridians with quality healthcare solutions. Let's explore what makes this coverage so appealing and why it might be the right choice for you.

This article will guide you through the intricacies of Florida Blue Cross Blue Shield coverage, ensuring you're well-equipped to navigate the health insurance landscape. From plan types to cost considerations, we'll cover it all to help you make the best decision for your healthcare needs.

- Alamance Crossing Burlington Nc

- Ross For Less Houston

- Renew Hotel Waikiki Honolulu

- New York City Police Department 94th Precinct

- Can Doordash Drivers See Tip

Table of Contents

- Introduction to Florida Blue Cross Blue Shield

- Types of Florida Blue Cross Blue Shield Plans

- Eligibility Criteria for Coverage

- Benefits of Florida Blue Cross Blue Shield Coverage

- Understanding Costs and Premiums

- Provider Networks and Coverage Areas

- Enrollment Process and Deadlines

- Limitations and Exclusions

- How to File Claims and Resolve Issues

- Tips for Choosing the Right Plan

Introduction to Florida Blue Cross Blue Shield

What is Florida Blue Cross Blue Shield?

Florida Blue Cross Blue Shield, part of the national Blue Cross Blue Shield network, is a leading health insurance provider in the state. It offers a variety of health insurance plans tailored to meet the diverse needs of individuals, families, and businesses. With a commitment to improving healthcare access and affordability, Florida Blue Cross Blue Shield has become a trusted name in the industry.

History and Reputation

Established over 80 years ago, Florida Blue Cross Blue Shield has grown to serve millions of Floridians. Its reputation is built on providing reliable coverage, innovative solutions, and a vast network of healthcare providers. The organization continuously adapts to meet the evolving healthcare needs of its members, ensuring they receive the best possible care.

Key highlights include:

- How To Keep An Apple Fresh After Cutting It

- Lilly Sabri Free Workout Plan

- Vegetables That Can Grow Indoors Without Sunlight

- Spirit Airlines Rat On Plane

- Washington Nat Prem Debit

- Comprehensive health insurance plans

- Wide network of healthcare providers

- Focus on customer satisfaction

Types of Florida Blue Cross Blue Shield Plans

Florida Blue Cross Blue Shield offers several types of plans to cater to different healthcare needs and budgets. Understanding these options is crucial when selecting the right coverage for you.

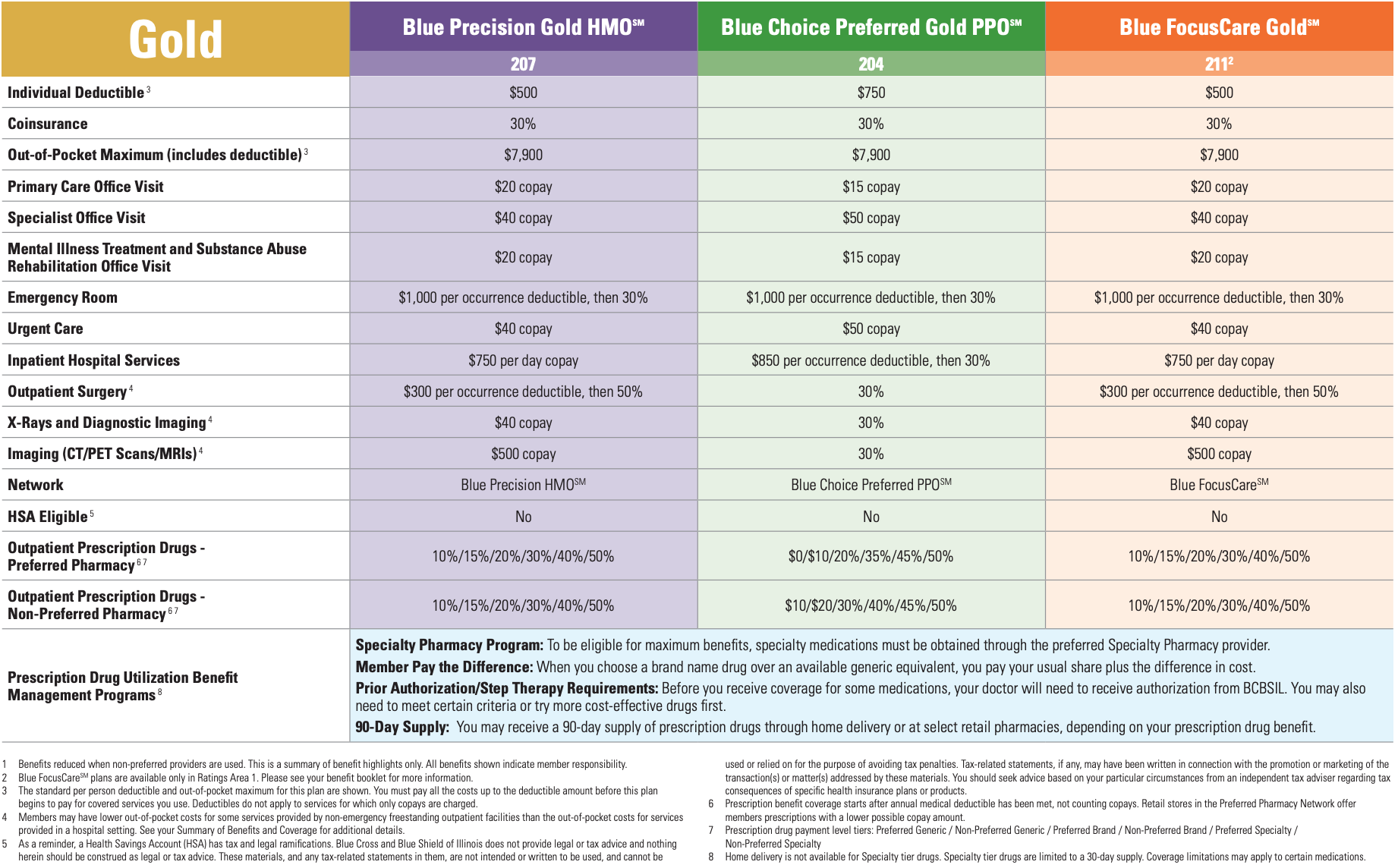

HMO (Health Maintenance Organization)

HMO plans typically require you to choose a primary care physician within the network. These plans often have lower out-of-pocket costs but may limit your options for specialists without a referral.

PPO (Preferred Provider Organization)

PPO plans provide more flexibility, allowing you to see specialists without a referral. While they may have higher premiums, they offer broader access to healthcare providers both in and out of network.

EPO (Exclusive Provider Organization)

EPO plans combine elements of HMOs and PPOs, offering lower costs while restricting you to in-network providers, except in emergencies.

HSA (Health Savings Account) Compatible Plans

HSA-compatible plans, often high-deductible health plans (HDHPs), allow you to save pre-tax dollars for medical expenses. They are ideal for those who want to manage their healthcare costs effectively.

Eligibility Criteria for Coverage

To qualify for Florida Blue Cross Blue Shield coverage, you must meet specific eligibility criteria. These requirements ensure that the plans are accessible to a wide range of individuals and businesses.

Individual and Family Plans

Individuals and families residing in Florida can enroll in these plans during the open enrollment period or during a special enrollment period due to qualifying life events. Coverage is available to U.S. citizens and legal residents.

Small Business Plans

Small businesses with fewer than 50 employees can offer group health insurance plans through Florida Blue Cross Blue Shield. These plans provide cost-effective solutions for businesses looking to attract and retain talent.

Benefits of Florida Blue Cross Blue Shield Coverage

Florida Blue Cross Blue Shield offers numerous benefits that make it a top choice for health insurance coverage. From preventive care to specialized treatments, these benefits ensure comprehensive healthcare for its members.

Preventive Care Services

Preventive care services, such as annual check-ups and screenings, are often covered at no additional cost. These services help detect potential health issues early, promoting overall well-being.

Specialized Treatments

Whether you need specialized care for chronic conditions or access to advanced medical technologies, Florida Blue Cross Blue Shield ensures you receive the necessary treatments. Their extensive network of specialists guarantees quality care.

Understanding Costs and Premiums

Understanding the costs associated with Florida Blue Cross Blue Shield coverage is vital for budgeting and planning. Premiums, deductibles, copayments, and coinsurance all play a role in determining your overall healthcare expenses.

Premiums

Premiums are the monthly payments you make to maintain your coverage. They vary based on the type of plan, level of coverage, and your age. Lower premiums often come with higher out-of-pocket costs, so it's essential to balance these factors when choosing a plan.

Out-of-Pocket Costs

Out-of-pocket costs include deductibles, copayments, and coinsurance. Knowing these costs upfront can help you prepare for potential medical expenses and avoid unexpected financial burdens.

Provider Networks and Coverage Areas

Florida Blue Cross Blue Shield boasts an extensive network of healthcare providers, ensuring you have access to quality care wherever you are in the state.

Network Types

Depending on your plan, you may have access to different types of provider networks, including HMO, PPO, and EPO networks. Each network has its own set of rules and benefits, so it's important to choose one that aligns with your healthcare needs.

Coverage Areas

Florida Blue Cross Blue Shield coverage is available throughout the state, with specific plans tailored to different regions. This ensures that no matter where you live in Florida, you have access to the care you need.

Enrollment Process and Deadlines

Enrolling in Florida Blue Cross Blue Shield coverage involves a straightforward process, but it's crucial to adhere to deadlines to avoid gaps in coverage.

Open Enrollment Period

The open enrollment period typically occurs once a year, allowing individuals and businesses to enroll in or change their health insurance plans. Missing this period may limit your options until the next year unless you experience a qualifying life event.

Special Enrollment Period

Special enrollment periods are available for those who experience significant life changes, such as marriage, childbirth, or loss of existing coverage. These periods provide flexibility in obtaining or modifying your health insurance plan.

Limitations and Exclusions

While Florida Blue Cross Blue Shield offers comprehensive coverage, it's important to be aware of any limitations or exclusions that may apply to your plan.

Exclusions

Certain services or treatments may not be covered under your plan, such as cosmetic procedures or experimental therapies. Reviewing your policy details can help you understand what is and isn't included in your coverage.

Pre-Existing Conditions

Under federal law, health insurance providers cannot deny coverage or charge higher premiums based on pre-existing conditions. Florida Blue Cross Blue Shield adheres to these regulations, ensuring equal access to coverage for all members.

How to File Claims and Resolve Issues

Filing claims and resolving issues with your Florida Blue Cross Blue Shield coverage is a straightforward process, but it requires attention to detail and timely action.

Filing Claims

To file a claim, you can submit the necessary documentation either online or by mail. Ensure all required forms and supporting materials are included to expedite the process.

Resolving Issues

If you encounter issues with your coverage or claims, Florida Blue Cross Blue Shield provides customer service support to assist you. Their dedicated team is available to address your concerns and help resolve any problems promptly.

Tips for Choosing the Right Plan

Selecting the right Florida Blue Cross Blue Shield plan involves evaluating your healthcare needs, budget, and lifestyle. Here are some tips to help you make an informed decision:

- Assess your healthcare needs and choose a plan that aligns with them.

- Compare premiums, deductibles, and out-of-pocket costs to find the best value.

- Consider the provider network and ensure your preferred doctors are included.

- Review the plan's benefits and exclusions to avoid surprises later.

Kesimpulan

Florida Blue Cross Blue Shield coverage offers a wide array of benefits and options to meet the diverse healthcare needs of Floridians. From comprehensive plans to flexible networks, this provider stands out as a reliable choice for health insurance. By understanding the types of plans, eligibility criteria, costs, and enrollment processes, you can make an informed decision that best suits your needs.

We encourage you to take action by exploring the available plans, comparing options, and enrolling in the coverage that aligns with your healthcare goals. Don't forget to share this article with others who may benefit from it and leave a comment below if you have any questions or feedback. For more insights into health insurance and related topics, explore our other articles on the site.

Remember, your health is your most valuable asset, and choosing the right coverage is a step towards securing it.

- Costco Near Amarillo Tx

- City Of Bpt Ct

- Sonic Drive In Clovis

- Cast Your Anxiety On The Lord

- Anadyr Adventures Valdez Ak

COVERAGE AREA Blue Cross Options

Blue Cross Blue Shield Federal Hearing Aid Coverage 2024 Dasha Emmalee

Blue Cross Blue Shield 2024 Rates Magda Roselle