Bullion Trading In New York: A Comprehensive Guide To Maximizing Your Investments

Bullion trading in New York is an essential component of the global financial market, offering investors a secure and lucrative way to diversify their portfolios. Whether you're a seasoned trader or just starting, understanding how bullion trading works in New York can significantly enhance your investment strategies. This guide will delve into the nuances of bullion trading, exploring its benefits, risks, and strategies to help you make informed decisions.

New York, being one of the world's leading financial hubs, provides a robust infrastructure for bullion trading. The city's strategic location and established financial institutions make it an attractive destination for investors looking to trade gold, silver, platinum, and palladium. As the demand for precious metals continues to rise, understanding the market dynamics in New York can be crucial for anyone interested in bullion trading.

This article aims to provide a detailed overview of bullion trading in New York, covering everything from market trends to regulatory frameworks. By the end of this guide, you will have a comprehensive understanding of how to navigate the bullion market effectively, ensuring you make the most out of your investments.

- Best Dressing For Seafood Salad

- I Came From A Middle Class Family

- Viola Agnes Neo Soul Cafe

- Scrap Yard Philadelphia Pa

- The Lodge Breckenridge Colorado

Table of Contents

- Overview of Bullion Trading in New York

- Understanding the Bullion Market in New York

- Benefits of Bullion Trading in New York

- Risks Involved in Bullion Trading

- Effective Strategies for Bullion Trading

- Regulations Governing Bullion Trading in New York

- Best Platforms for Bullion Trading in New York

- Tips for Beginners in Bullion Trading

- Future Trends in Bullion Trading

- Conclusion and Call to Action

Overview of Bullion Trading in New York

What is Bullion Trading?

Bullion trading refers to the buying and selling of precious metals such as gold, silver, platinum, and palladium in the form of bars, coins, or ingots. In New York, bullion trading has gained significant traction due to the city's status as a global financial center. The New York Mercantile Exchange (NYMEX) plays a crucial role in facilitating these transactions, providing a platform for traders worldwide.

Bullion trading in New York is not just about buying and selling metals; it also involves understanding market trends, economic indicators, and geopolitical factors that influence prices. Investors often turn to bullion as a hedge against inflation and currency fluctuations, making it an attractive asset class.

Why Choose New York for Bullion Trading?

New York offers several advantages for bullion traders, including a well-established financial infrastructure, access to major exchanges, and a pool of experienced professionals. Additionally, the city's proximity to key global markets ensures liquidity and transparency in transactions.

- Who Are The Parents Of Thomas Matthew Crooks

- Facebook Marketplace People Asking For Phone Number

- How To Keep An Apple Fresh After Cutting It

- How To Use Piping Bags

- Alamance Crossing Burlington Nc

- Access to major exchanges like NYMEX

- Strong regulatory framework

- High liquidity and market transparency

Understanding the Bullion Market in New York

The bullion market in New York is characterized by its complexity and volatility. Traders need to be well-versed in market dynamics, including supply and demand factors, global economic conditions, and geopolitical events. Understanding these elements is crucial for making informed trading decisions.

Key Players in the Bullion Market

Several key players influence the bullion market in New York, including financial institutions, hedge funds, and individual investors. These entities contribute to the market's liquidity and stability, ensuring that traders have access to a wide range of opportunities.

- Financial institutions

- Hedge funds

- Individual investors

Benefits of Bullion Trading in New York

Bullion trading in New York offers numerous benefits, making it an attractive option for investors. Some of these advantages include:

- Diversification: Bullion provides a way to diversify investment portfolios, reducing overall risk.

- Inflation Hedge: Precious metals act as a hedge against inflation, preserving wealth over time.

- Global Demand: The increasing global demand for precious metals ensures a stable market.

Risks Involved in Bullion Trading

While bullion trading in New York offers significant benefits, it is not without risks. Traders must be aware of these risks to mitigate potential losses.

- Market volatility

- Geopolitical uncertainties

- Economic fluctuations

How to Manage Risks in Bullion Trading

Effective risk management strategies can help traders navigate the challenges of bullion trading. These strategies include setting stop-loss orders, diversifying investments, and staying informed about market trends.

Effective Strategies for Bullion Trading

Developing a sound trading strategy is essential for success in bullion trading. Below are some strategies that traders can employ:

- Long-term Investment: Focus on holding bullion for the long term to benefit from price appreciation.

- Technical Analysis: Use technical indicators to identify entry and exit points.

- Fundamental Analysis: Analyze economic data and geopolitical events to predict market movements.

Regulations Governing Bullion Trading in New York

Bullion trading in New York is subject to strict regulations designed to ensure market integrity and protect investors. The Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) oversee these regulations, ensuring compliance with federal laws.

Key Regulations to Know

- Commodity Exchange Act

- Dodd-Frank Wall Street Reform and Consumer Protection Act

- Anti-Money Laundering (AML) regulations

Best Platforms for Bullion Trading in New York

Choosing the right platform is crucial for successful bullion trading. Some of the best platforms for bullion trading in New York include:

- NYMEX

- London Bullion Market Association (LBMA)

- Online brokers like Interactive Brokers and TD Ameritrade

Tips for Beginners in Bullion Trading

For those new to bullion trading, here are some tips to help you get started:

- Start with a small investment to test the waters.

- Stay informed about market trends and economic indicators.

- Seek advice from experienced traders or financial advisors.

Future Trends in Bullion Trading

The future of bullion trading in New York looks promising, with advancements in technology and increasing global demand. Key trends to watch include:

- Increased adoption of digital platforms

- Growing interest in sustainable and ethical investing

- Emergence of new markets and trading opportunities

Conclusion and Call to Action

In conclusion, bullion trading in New York presents a lucrative opportunity for investors looking to diversify their portfolios and protect their wealth. By understanding the market dynamics, employing effective strategies, and staying informed about regulations, traders can maximize their returns and minimize risks.

We encourage you to take the first step in your bullion trading journey by exploring the resources and platforms mentioned in this guide. Don't forget to share your thoughts and experiences in the comments section below, and consider exploring other articles on our site for more insights into the world of finance.

- Who Are The Parents Of Thomas Matthew Crooks

- Sonic Drive In Frisco Tx

- Forest Grove Christian Reformed Church

- Beauty And Essex Reviews

- Can Doordash Drivers See Tip

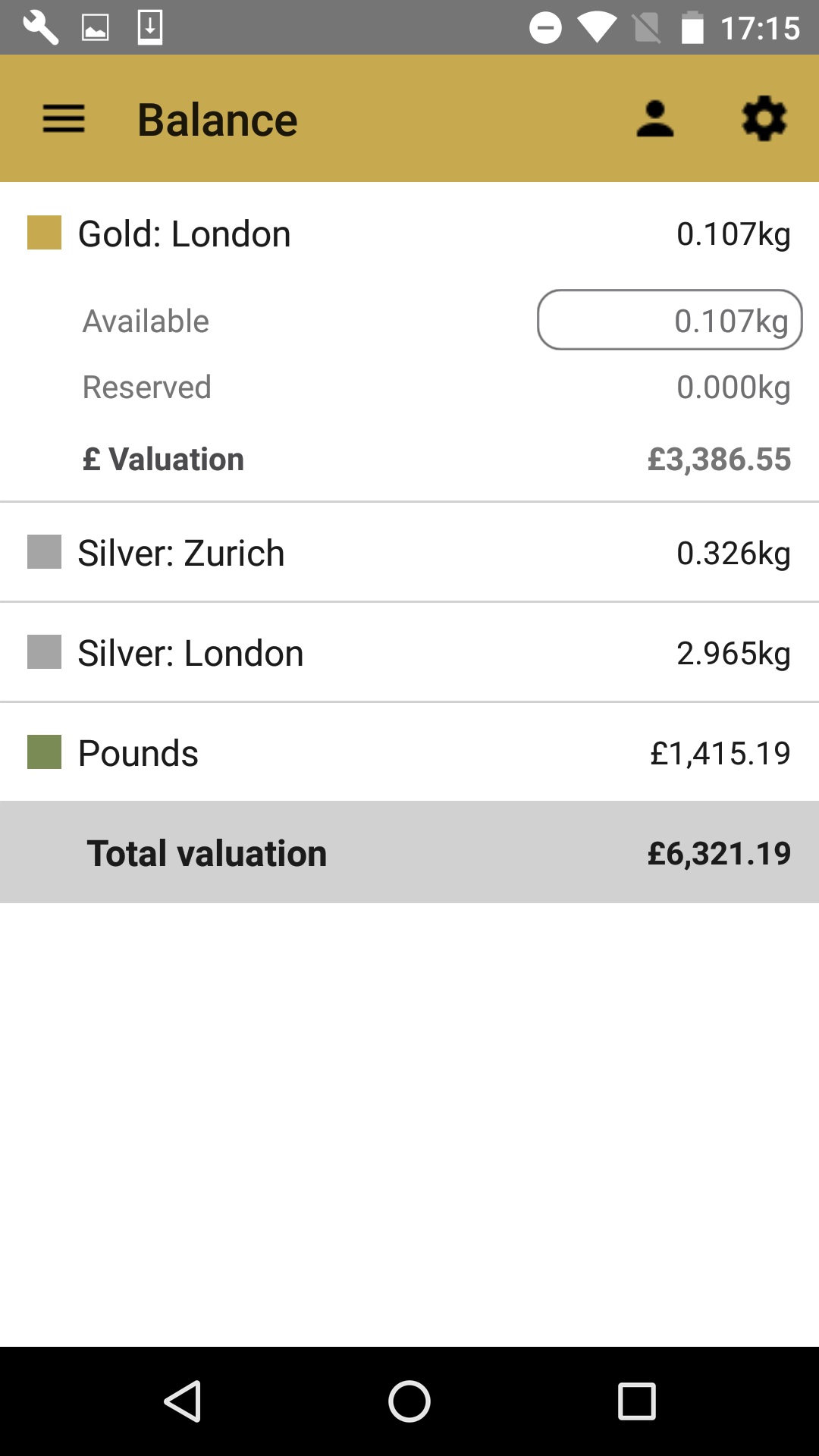

Mobile Bullion Trading App Trade Gold and Silver on the Move

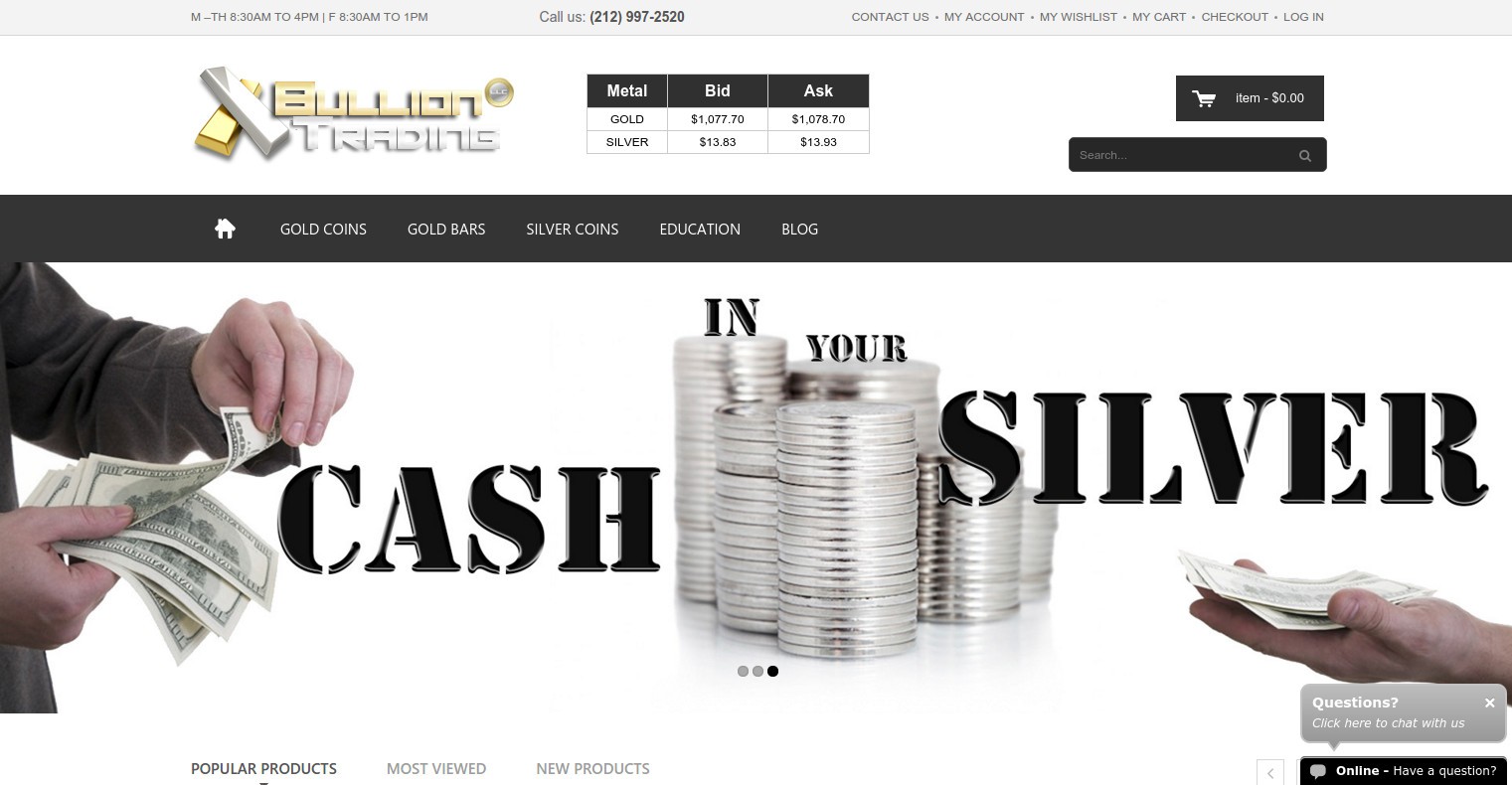

Bullion Trading LLC New York, New York Coin Dealer Reviews

Bullion Trading LLC New York, New York Coin Dealer Reviews