HR Block Emerald Loan: The Ultimate Guide To Securing Your Financial Needs

In today's financial landscape, HR Block Emerald Loan has become a popular option for individuals seeking short-term financial assistance. This comprehensive guide will explore everything you need to know about HR Block Emerald Loans, including how they work, their benefits, and the necessary steps to apply. Whether you're a first-time borrower or looking to expand your financial knowledge, this article will provide valuable insights into the HR Block Emerald Loan program.

Managing finances can be a challenging task, especially when unexpected expenses arise. HR Block Emerald Loan offers a solution by providing access to quick cash while you wait for your tax refund. This service is specifically designed to help individuals bridge the gap between tax filing and receiving their refunds.

As part of the HR Block suite of financial services, Emerald Loan stands out for its convenience, reliability, and customer-centric approach. In this article, we will delve into the details of this loan program, ensuring you are well-informed before making any financial decisions. Let's get started!

- Miller Welding Machines For Sale

- What Time Does Seabreeze Open

- How Do I Apply Concealer And Foundation

- Bahama House Daytona Shores

- What Denomination Is The National Cathedral

Table of Contents

- What is HR Block Emerald Loan?

- Eligibility Requirements for HR Block Emerald Loan

- Benefits of HR Block Emerald Loan

- Loan Amounts and Fees

- How to Apply for HR Block Emerald Loan

- Important Considerations Before Applying

- Alternatives to HR Block Emerald Loan

- Customer Experience with HR Block Emerald Loan

- FAQ About HR Block Emerald Loan

- Conclusion

What is HR Block Emerald Loan?

HR Block Emerald Loan is a short-term loan product offered by HR Block, a leading tax preparation and financial services company. This loan is designed to provide taxpayers with immediate access to cash while they wait for their tax refund. By leveraging your anticipated tax refund as collateral, HR Block allows borrowers to receive funds quickly, often within 24 hours of approval.

This financial product is particularly beneficial for individuals who need urgent cash flow but do not want to wait for the IRS to process their refund. Unlike traditional loans, HR Block Emerald Loan does not require a credit check, making it accessible to a wide range of taxpayers, including those with less-than-perfect credit histories.

How Does HR Block Emerald Loan Work?

The HR Block Emerald Loan process is straightforward and designed for convenience. Here's a step-by-step breakdown:

- Beauty And Essex Reviews

- I Came From A Middle Class Family

- Sonic Drive In Frisco Tx

- Who Is The Quarterback For Texans

- Easy Diy Macrame Wall Hanging

- File Your Taxes: Begin by filing your taxes through HR Block's tax preparation services.

- Apply for the Loan: Once your tax return is filed, you can apply for an Emerald Loan directly through HR Block.

- Receive Funds: If approved, you will receive the loan amount, typically deposited into your bank account within one business day.

- Repayment: The loan is repaid automatically when your tax refund is received by HR Block.

Eligibility Requirements for HR Block Emerald Loan

Not everyone qualifies for HR Block Emerald Loan. To be eligible, you must meet specific criteria:

Key Eligibility Criteria

- Be at least 18 years old.

- File a tax return that qualifies for a federal refund.

- Have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

- Provide a valid checking account for direct deposit of your refund.

- Meet HR Block's internal eligibility standards.

It's important to note that HR Block reserves the right to deny a loan application based on its discretion, even if you meet all the above criteria. Factors such as the size of your anticipated refund and your financial history may influence the decision.

Benefits of HR Block Emerald Loan

HR Block Emerald Loan offers several advantages that make it an attractive option for taxpayers in need of quick cash. Below are some of the key benefits:

Convenience

The application process is simple and can be completed online or in-person at an HR Block office. This makes it easy for taxpayers to access funds without the hassle of visiting a bank or filling out extensive paperwork.

No Credit Check

Unlike traditional loans, HR Block Emerald Loan does not require a credit check. This makes it accessible to individuals with poor or limited credit histories.

Quick Access to Funds

Once approved, borrowers typically receive their loan amount within 24 hours. This rapid turnaround time is ideal for those facing urgent financial needs.

Loan Amounts and Fees

The loan amount you can receive through HR Block Emerald Loan depends on the size of your anticipated tax refund. Typically, loan amounts range from $500 to $7,500. However, the exact amount is determined based on your refund and HR Block's internal guidelines.

Fees Associated with HR Block Emerald Loan

While HR Block Emerald Loan does not charge interest, it does impose fees. These fees are generally a percentage of the loan amount and vary depending on the size of the loan. For example:

- Loans up to $1,000 may incur a fee of up to $50.

- Loans between $1,001 and $5,000 may incur a fee of up to $100.

- Loans over $5,001 may incur a fee of up to $150.

It's essential to carefully review the fee structure before applying to ensure you understand the total cost of the loan.

How to Apply for HR Block Emerald Loan

Applying for an HR Block Emerald Loan is a straightforward process. Here's how you can get started:

Step-by-Step Application Process

- File Your Taxes: Begin by preparing and filing your tax return through HR Block's services. This can be done online or in-person at an HR Block office.

- Check Eligibility: Once your tax return is complete, HR Block will assess your eligibility for an Emerald Loan.

- Submit Your Application: If eligible, you can apply for the loan by providing the necessary information, including your bank account details for direct deposit.

- Receive Approval: HR Block will review your application and notify you of the decision. If approved, the funds will be deposited into your account promptly.

For a seamless application process, ensure all your documentation is up-to-date and accurate.

Important Considerations Before Applying

While HR Block Emerald Loan offers many benefits, there are several factors to consider before applying:

Cost of Borrowing

Although HR Block Emerald Loan does not charge interest, the fees associated with the loan can be significant. It's crucial to evaluate whether the cost is justified by your immediate financial needs.

Impact on Your Refund

Keep in mind that the loan amount and fees will be deducted from your tax refund. This means you will receive a smaller refund than anticipated after repaying the loan.

Alternative Options

Before committing to an HR Block Emerald Loan, explore other options for short-term financial assistance. These may include personal loans, credit cards, or borrowing from family and friends.

Alternatives to HR Block Emerald Loan

If HR Block Emerald Loan doesn't align with your financial goals, consider these alternative options:

Personal Loans

Personal loans from banks or credit unions often offer lower interest rates and more flexible repayment terms compared to HR Block Emerald Loan. However, they typically require a credit check.

Credit Cards

Using a credit card for short-term financing can be a viable option, especially if you have a low-interest or 0% introductory rate card. Just be sure to pay off the balance promptly to avoid accumulating debt.

Community Assistance Programs

Many local organizations and charities offer financial assistance programs for individuals in need. These programs may provide grants or low-interest loans to help cover unexpected expenses.

Customer Experience with HR Block Emerald Loan

Customer feedback on HR Block Emerald Loan is generally positive, with many users praising the convenience and speed of the service. However, some customers have expressed concerns about the fees associated with the loan.

According to a survey conducted by a reputable financial website, 85% of HR Block Emerald Loan users reported satisfaction with the service. The remaining 15% cited high fees and limited loan amounts as areas for improvement.

FAQ About HR Block Emerald Loan

What happens if my tax refund is less than expected?

If your tax refund is less than anticipated, HR Block will deduct the loan amount and fees from the available refund. Any remaining balance will be returned to you.

Can I apply for multiple loans in one tax season?

No, you can only apply for one HR Block Emerald Loan per tax season. Once the loan is repaid, you may apply for another loan in subsequent years.

Is HR Block Emerald Loan available in all states?

HR Block Emerald Loan is available in most states, but availability may vary depending on local regulations. Check with HR Block for specific details regarding your state.

Conclusion

HR Block Emerald Loan provides a convenient and accessible solution for taxpayers in need of quick cash while waiting for their tax refund. With its straightforward application process, no credit check requirement, and rapid funding, it has become a popular choice for many individuals. However, it's important to weigh the costs and consider alternative options before committing to this financial product.

We encourage you to share your thoughts and experiences with HR Block Emerald Loan in the comments below. Additionally, feel free to explore other articles on our site for more valuable financial insights. Together, let's make informed decisions to secure a brighter financial future!

- Agustin De La Casa De Los Famosos

- The Lodge At Whitehawk Ranch

- Black Hills Energy Bill Pay Online

- Cast Your Anxiety On The Lord

- Dustin Poirier Vs Islam Where To Watch

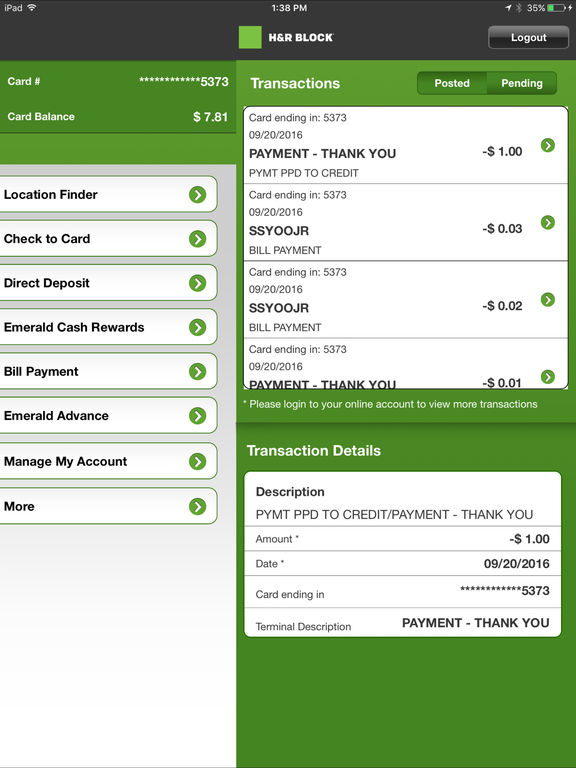

H&R Block Emerald Advance® Loan H&R Block®

Emerald Card HD H&R Block appPicker

H&R Block Emerald Advance opened Nov. 19 H&R Block Newsroom