Understanding California Income Tax Status: A Comprehensive Guide

California income tax status is a crucial aspect of financial planning for residents and businesses within the state. Whether you're an individual taxpayer or a business owner, understanding how California's tax system works is essential to ensure compliance and optimize your financial health. This article aims to provide an in-depth exploration of California's income tax structure, key considerations, and actionable tips to help you navigate this complex area.

California boasts the largest economy in the United States, and its tax policies play a significant role in shaping the financial landscape for its residents. The state's progressive income tax system is designed to generate revenue while ensuring fairness across different income brackets. However, the intricacies of California's tax laws can be overwhelming, especially for newcomers or those unfamiliar with the system.

This guide will walk you through the essential aspects of California income tax status, from understanding the basics to exploring advanced strategies for tax optimization. By the end of this article, you'll have a clearer understanding of how to manage your tax obligations effectively and make informed financial decisions.

- Rack Room Shoes Cary Nc

- Peliculas De Anime En Netflix

- Where Do Pancakes Originate From

- Sam Woo Cafe Cerritos

- Larson Mental Health Boulder

Table of Contents

- Introduction to California Income Tax Status

- Overview of California's Income Tax System

- California Income Tax Filing Status Options

- California Income Tax Brackets and Rates

- Deductions and Credits in California

- Tax Obligations for Non-Residents

- California Business Income Tax

- The California Income Tax Filing Process

- Penalties for Non-Compliance

- Tips for Managing California Income Tax

- Conclusion

Introduction to California Income Tax Status

California's income tax system is one of the most robust in the nation, designed to support the state's extensive public services and infrastructure. Understanding your tax status is the first step toward ensuring compliance and optimizing your financial situation.

Why California's Tax System Matters

California's tax policies have a direct impact on the financial well-being of its residents. The state's progressive tax structure means that higher-income earners contribute a larger percentage of their income compared to lower-income individuals. This system aims to create a more equitable distribution of resources while supporting essential services like education, healthcare, and public safety.

Overview of California's Income Tax System

California employs a progressive income tax system, which means that tax rates increase as income levels rise. This structure is designed to ensure that individuals and businesses contribute fairly based on their earnings.

- Renew Hotel Waikiki Honolulu

- How To Keep An Apple Fresh After Cutting It

- Pete S Piano Bar San Antonio

- When Is Jenni Rivera S Birthday

- Lilly Sabri Free Workout Plan

Key Features of the System

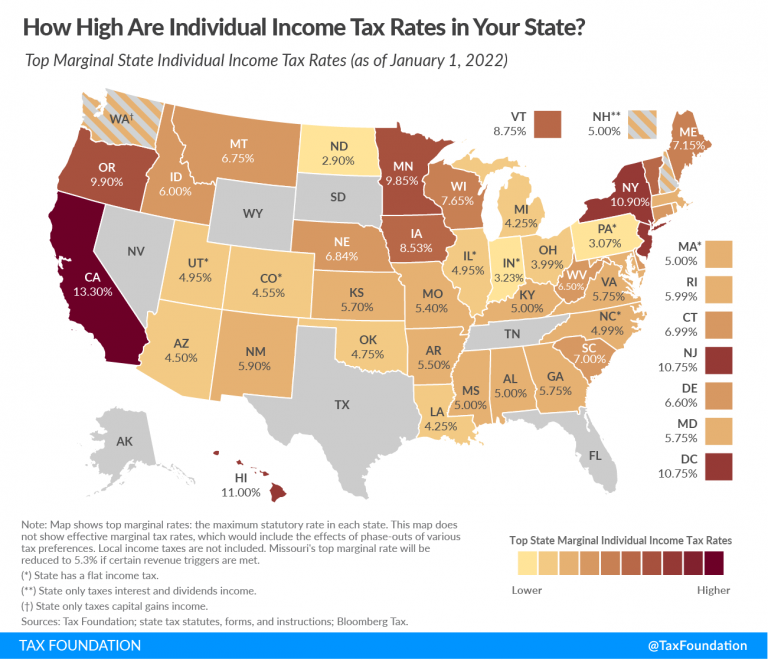

- Progressive tax rates ranging from 1% to 13.3% for high-income earners.

- Separate tax brackets for single filers, married couples filing jointly, and heads of households.

- Special provisions for non-residents and part-year residents.

California Income Tax Filing Status Options

Choosing the correct filing status is crucial when preparing your California income tax return. The state recognizes several filing statuses, each with its own set of rules and benefits.

Available Filing Statuses

- Single: For individuals who are unmarried or legally separated.

- Married Filing Jointly: For couples who wish to file a single return together.

- Married Filing Separately: For couples who prefer to file separate returns.

- Head of Household: For unmarried individuals who provide financial support for a qualifying person.

California Income Tax Brackets and Rates

California's income tax brackets are structured to accommodate various income levels. The state's progressive tax system ensures that higher-income earners contribute proportionally more to state revenue.

2023 Tax Brackets

For single filers, the tax brackets are as follows:

- $0 - $10,099: 1%

- $10,100 - $27,249: 2%

- $27,250 - $42,749: 4%

- $42,750 - $58,249: 6%

- $58,250 - $336,349: 8%

- $336,350 - $681,549: 9.3%

- $681,550+: 10.3% to 13.3% for the highest earners

Deductions and Credits in California

California offers a variety of deductions and credits to help taxpayers reduce their taxable income and lower their overall tax liability. Taking advantage of these provisions can result in significant savings.

Common Deductions and Credits

- Standard Deduction: A fixed amount that reduces taxable income for those who do not itemize deductions.

- Itemized Deductions: Includes expenses like mortgage interest, charitable contributions, and state and local taxes.

- California Earned Income Tax Credit (CalEITC): Provides financial relief for low-to-moderate-income individuals and families.

Tax Obligations for Non-Residents

Non-residents who earn income in California are also subject to the state's income tax laws. Understanding your obligations as a non-resident is essential to avoid penalties and ensure compliance.

Key Considerations for Non-Residents

- Only income sourced from California is subject to state taxation.

- Non-residents must file Form 540NR to report their California-sourced income.

- Special rules apply for part-year residents who spend part of the year in California.

California Business Income Tax

Businesses operating in California are subject to both federal and state income taxes. The state imposes a corporate tax rate of 8.84% on net income, with additional provisions for franchise taxes and credits.

Key Aspects of Business Taxation

- Corporate Tax Rate: 8.84% on net income.

- Franchise Tax: A minimum annual tax of $800 for corporations and LLCs.

- Credits: Available for research and development expenses, hiring disadvantaged workers, and other qualifying activities.

The California Income Tax Filing Process

Filing your California income tax return involves several steps, from gathering necessary documents to submitting your return by the deadline. Understanding the process can help you avoid common mistakes and ensure a smooth filing experience.

Steps to File Your Return

- Gather all necessary documents, including W-2s, 1099s, and receipts for deductions.

- Choose the appropriate filing status and forms based on your situation.

- Calculate your taxable income and apply any applicable deductions and credits.

- Submit your return electronically or by mail by April 15th.

Penalties for Non-Compliance

Failing to comply with California's income tax laws can result in significant penalties and interest charges. It's essential to understand the consequences of non-compliance and take steps to avoid them.

Common Penalties

- Failure to File Penalty: 5% of unpaid taxes for each month the return is late, up to a maximum of 25%.

- Failure to Pay Penalty: 0.5% of unpaid taxes for each month the payment is late.

- Interest Charges: Interest accrues on unpaid taxes at a rate set by the Franchise Tax Board.

Tips for Managing California Income Tax

Effectively managing your California income tax obligations requires careful planning and attention to detail. Here are some actionable tips to help you stay compliant and minimize your tax burden.

Strategies for Tax Optimization

- Keep detailed records of all income and expenses throughout the year.

- Consult with a tax professional or accountant to ensure compliance and identify potential deductions.

- Take advantage of available credits and deductions to reduce your taxable income.

- Plan for estimated tax payments if you have self-employment or investment income.

Conclusion

In conclusion, understanding California income tax status is vital for individuals and businesses within the state. By familiarizing yourself with the state's tax system, filing requirements, and available deductions, you can ensure compliance and optimize your financial situation. Remember to stay informed about updates to tax laws and consult with a professional if needed.

We encourage you to share this article with others who may find it helpful and leave a comment below if you have any questions or feedback. For more information on California income tax and related topics, explore our other articles on the website.

- Ustaad G76 Indian Cuisine

- How To Use Piping Bags

- Can Doordash Drivers See Tip

- What Time Does Seabreeze Open

- Washington Nat Prem Debit

California State Tax Tables

2025 California Tax Brackets Pdf Ruby Vaughn

California Tax Brackets 2024 Maiga Roxanna