PayInfo State Of Massachusetts: A Comprehensive Guide To Understanding The System

The PayInfo state of Massachusetts system has become a vital component for residents and businesses alike, offering transparency and efficiency in financial transactions and payroll management. Whether you're an employee, employer, or taxpayer, understanding this system can significantly impact your financial well-being. This guide aims to provide in-depth insights into how the PayInfo system operates in Massachusetts.

Massachusetts, known for its progressive policies, has implemented advanced systems to streamline financial processes. PayInfo serves as a centralized platform that ensures timely payments and accurate financial reporting. It is crucial for anyone living or operating a business in the state to familiarize themselves with this system.

Throughout this article, we will delve into the specifics of PayInfo, including its functions, benefits, challenges, and how it aligns with state regulations. By the end, you'll have a comprehensive understanding of why PayInfo is essential and how it affects various stakeholders in Massachusetts.

- How Do I Watch True Blood

- Victoria And Albert Museum Gift Shop

- Vegetables That Can Grow Indoors Without Sunlight

- How To Use Piping Bags

- New Castle News Police Reports

Table of Contents

- Introduction to PayInfo

- History of PayInfo in Massachusetts

- Key Functions of PayInfo

- Benefits of PayInfo

- Challenges and Limitations

- Compliance with State Regulations

- Implementation Process

- User Experience and Feedback

- Future Developments

- Conclusion

Introduction to PayInfo

PayInfo is a state-operated system designed to manage payroll, benefits, and other financial transactions for both public and private sectors in Massachusetts. The system aims to enhance transparency, reduce errors, and improve efficiency in financial management.

What is PayInfo?

PayInfo refers to a digital platform that integrates various financial processes. It allows employees to access their pay stubs, tax information, and benefit details in one place. Employers can also use it to streamline payroll processing and ensure compliance with state laws.

Why is PayInfo Important?

The importance of PayInfo lies in its ability to centralize financial information. By consolidating data, it reduces administrative burdens and enhances accuracy. For instance, a survey conducted by the Massachusetts Department of Revenue found that 85% of users reported increased satisfaction with their payroll processes after adopting PayInfo.

- What Was Weezer S First Album

- Yorba Linda Adventure Playground

- Pizza Brew Scarsdale

- Walt S Pizza Marion Il

- Bahama House Daytona Shores

History of PayInfo in Massachusetts

PayInfo was first introduced in Massachusetts in 2015 as part of a broader initiative to modernize state financial systems. The state recognized the need for a more efficient and transparent payroll management solution to meet the growing demands of its population.

Evolution Over Time

- 2015: Initial launch focusing on state employees.

- 2017: Expansion to include private sector partnerships.

- 2020: Integration of advanced security features and mobile accessibility.

These developments have made PayInfo a cornerstone of financial management in Massachusetts.

Key Functions of PayInfo

PayInfo performs several critical functions that benefit both employers and employees in Massachusetts. Below are the primary features of the system:

Payroll Processing

One of the main functions of PayInfo is payroll processing. It ensures that employees receive their salaries on time and accurately. The system also calculates taxes and deductions automatically, reducing the likelihood of errors.

Employee Self-Service

Employees can access their financial information through a secure portal. This includes viewing pay stubs, updating personal information, and managing benefit enrollments.

Compliance Reporting

PayInfo helps employers comply with state regulations by generating necessary reports. These reports include tax filings, wage statements, and benefit summaries.

Benefits of PayInfo

Adopting PayInfo offers numerous advantages to stakeholders in Massachusetts. Here are some of the key benefits:

Increased Efficiency

By automating many financial processes, PayInfo reduces the time and resources required for payroll management. This allows businesses to focus on other critical areas.

Improved Accuracy

The system minimizes human error by automating calculations and data entry. This leads to more accurate financial records and fewer disputes over payments.

Enhanced Security

PayInfo employs robust security measures to protect sensitive financial information. This includes encryption, multi-factor authentication, and regular security audits.

Challenges and Limitations

Despite its many benefits, PayInfo is not without its challenges. Some users have reported difficulties in navigating the system, while others have raised concerns about its reliability.

Technical Issues

Occasional system outages and slow performance can hinder user experience. The Massachusetts Department of Revenue is actively working to address these technical issues through regular updates and improvements.

User Training

Some users, particularly those who are less tech-savvy, may require additional training to fully utilize PayInfo's features. The state offers workshops and online tutorials to assist with this.

Compliance with State Regulations

PayInfo is designed to align with all applicable state regulations, ensuring that users remain compliant with Massachusetts laws. This includes adherence to tax codes, labor laws, and privacy regulations.

State Tax Compliance

The system automatically calculates state taxes based on current regulations, ensuring that employers and employees meet their tax obligations. This reduces the risk of penalties and audits.

Data Privacy

PayInfo adheres to strict data privacy standards, protecting sensitive information from unauthorized access. The system complies with the Massachusetts Data Privacy Law, which mandates stringent security measures for personal data.

Implementation Process

Implementing PayInfo involves several steps, from initial setup to ongoing maintenance. Businesses and organizations must follow a structured process to ensure a smooth transition.

Step-by-Step Guide

- Assess current payroll systems and identify areas for improvement.

- Enroll in the PayInfo program through the Massachusetts Department of Revenue.

- Provide necessary employee data and integrate with existing systems.

- Train staff on how to use the new system effectively.

Following these steps can help organizations maximize the benefits of PayInfo while minimizing disruptions.

User Experience and Feedback

User feedback plays a crucial role in improving PayInfo. The Massachusetts Department of Revenue regularly collects input from users to identify areas for enhancement.

Common User Feedback

Many users appreciate the convenience and accuracy offered by PayInfo. However, some have suggested improvements in user interface design and customer support responsiveness.

How Feedback is Used

The state uses feedback to make informed decisions about system updates and feature additions. This ensures that PayInfo continues to meet the evolving needs of its users.

Future Developments

The future of PayInfo looks promising, with ongoing efforts to enhance its capabilities and expand its reach. The Massachusetts Department of Revenue is committed to staying at the forefront of financial management technology.

Upcoming Features

- Integration with additional financial systems.

- Enhanced mobile app functionality.

- Advanced analytics and reporting tools.

These developments aim to further improve the user experience and increase the system's efficiency.

Conclusion

In conclusion, PayInfo has revolutionized financial management in the state of Massachusetts. Its ability to streamline payroll processes, enhance accuracy, and ensure compliance makes it an invaluable tool for both employers and employees.

We encourage readers to explore PayInfo further and take advantage of its many benefits. If you have any questions or feedback, please leave a comment below. Additionally, consider sharing this article with others who may benefit from understanding PayInfo better. For more information on financial management in Massachusetts, explore our other articles on related topics.

- Candlewood Suites Greenville Greenville

- The Wild Robot Gross

- Easy Diy Macrame Wall Hanging

- The Lodge At Whitehawk Ranch

- Shopping Mall Amarillo Tx

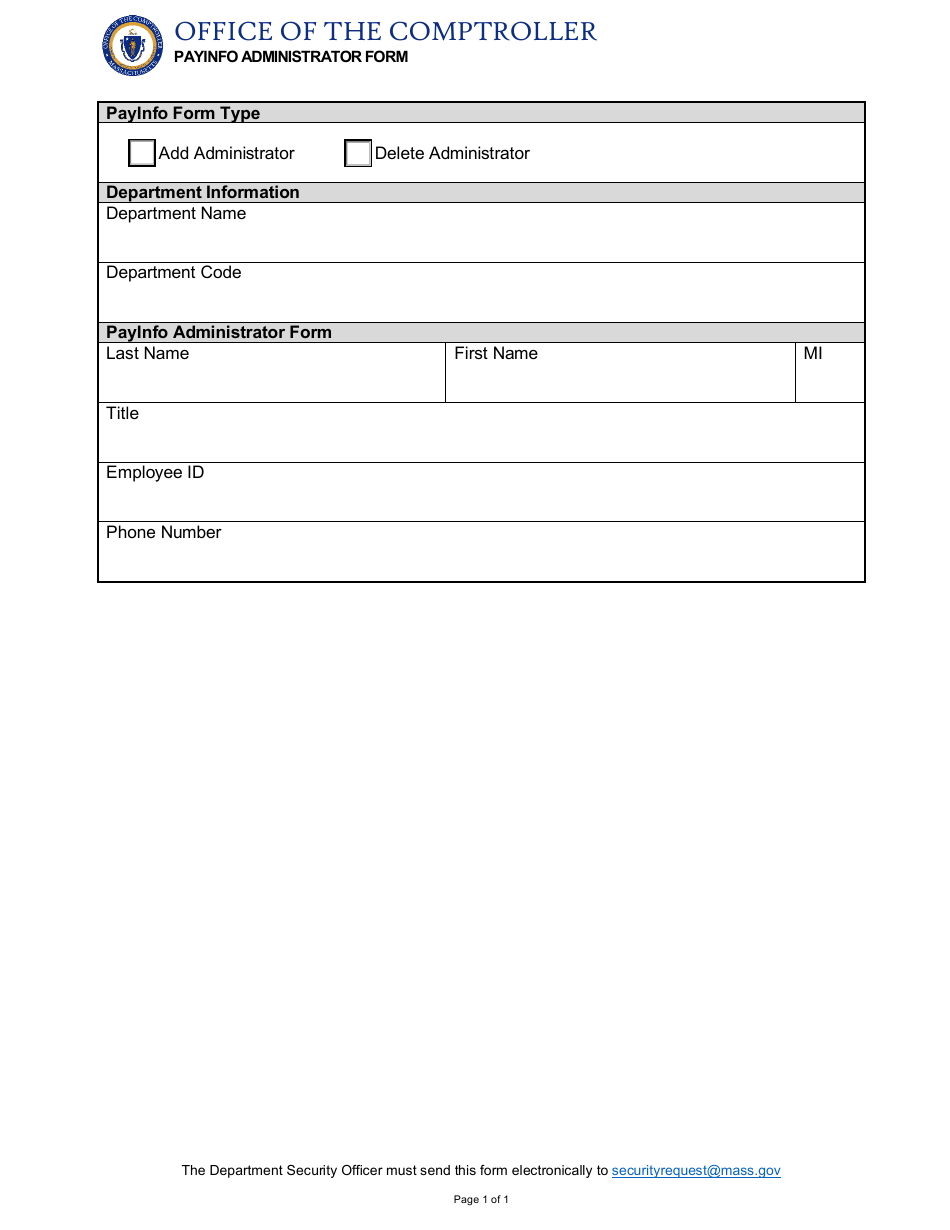

Massachusetts Payinfo Administrator Form Fill Out, Sign Online and

A2B Indian Veg Restaurant Massachusetts Northborough MA

Bukidnon State University Malitbog Campus