New York Times Rent Vs Buy Calculator: Your Ultimate Guide To Making Smart Financial Decisions

The debate between renting and buying a home has been a long-standing topic of discussion for many individuals and families. The New York Times Rent vs Buy Calculator has emerged as a powerful tool to help people make informed decisions based on their financial circumstances. Whether you're a first-time homebuyer or someone considering a change in living arrangements, understanding the nuances of renting versus buying is crucial.

This calculator provides a detailed analysis of the costs associated with both options, helping you weigh the pros and cons effectively. By factoring in variables such as property prices, mortgage rates, rental costs, and potential appreciation, the New York Times Rent vs Buy Calculator simplifies the decision-making process.

In this comprehensive guide, we will delve into the intricacies of the New York Times Rent vs Buy Calculator, exploring its features, benefits, and how it can assist you in making the right financial choice. Let’s get started!

- Pete S Piano Bar San Antonio

- City Of Bpt Ct

- Gkn Bowling Green Ohio

- Costco Near Amarillo Tx

- Hca Florida Mercy Hospital Emergency Room

Table of Contents

- Introduction to the Rent vs Buy Calculator

- How the New York Times Rent vs Buy Calculator Works

- Key Features of the Calculator

- Benefits of Using the Rent vs Buy Calculator

- Factors to Consider When Using the Calculator

- Common Mistakes to Avoid

- Renting vs Buying: A Detailed Comparison

- Financial Considerations for Homeownership

- Long-Term Implications of Renting vs Buying

- Conclusion and Next Steps

Introduction to the Rent vs Buy Calculator

The New York Times Rent vs Buy Calculator is designed to empower individuals with the information they need to make smart financial decisions about housing. With housing being one of the largest expenses for most people, it's essential to evaluate all aspects of renting versus buying. This calculator goes beyond simple comparisons by incorporating a range of factors that influence your decision.

Whether you're planning to stay in a location for a short period or considering long-term homeownership, the calculator offers insights into the financial implications of each choice. By inputting specific data about your situation, you can generate a personalized analysis tailored to your unique circumstances.

How the New York Times Rent vs Buy Calculator Works

The functionality of the New York Times Rent vs Buy Calculator is straightforward yet powerful. Here’s how it works:

- Vegetables That Can Grow Indoors Without Sunlight

- How Do I Watch True Blood

- City Of Milwaukee Recycling Pickup

- Michigan Works Benton Harbor Mi

- Cavinder Twins Sports Illustrated

Step-by-Step Guide

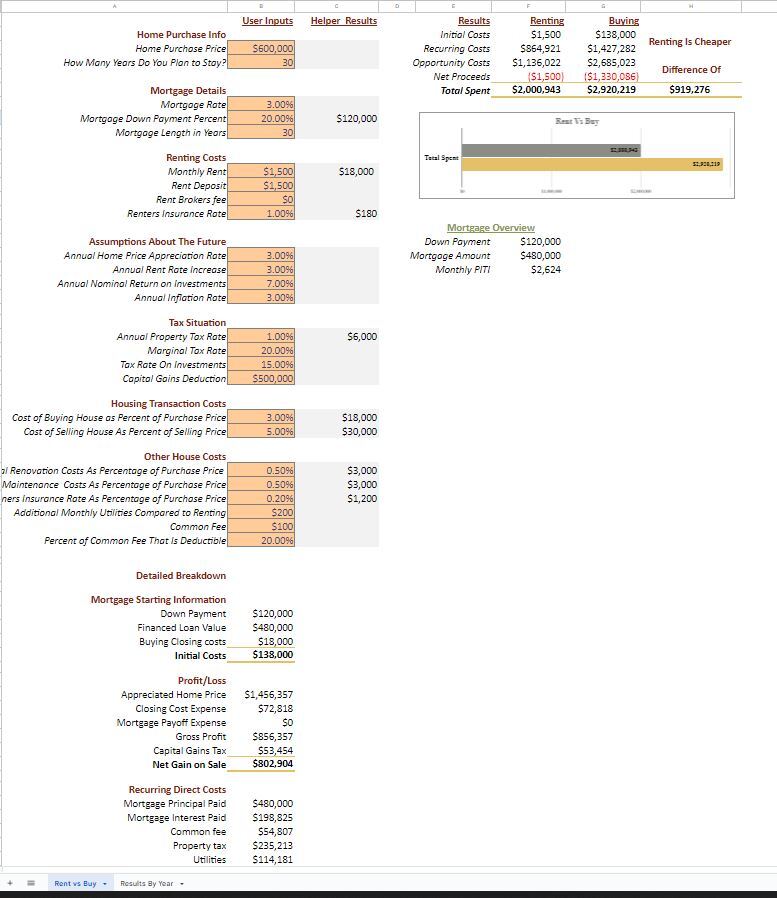

- Input Basic Information: Start by entering details such as the purchase price of the home, estimated rental cost, down payment, and mortgage interest rate.

- Add Additional Costs: Include other expenses like property taxes, insurance, maintenance costs, and potential appreciation rates.

- Set Timeframe: Specify how long you plan to stay in the property, as this significantly impacts the overall cost analysis.

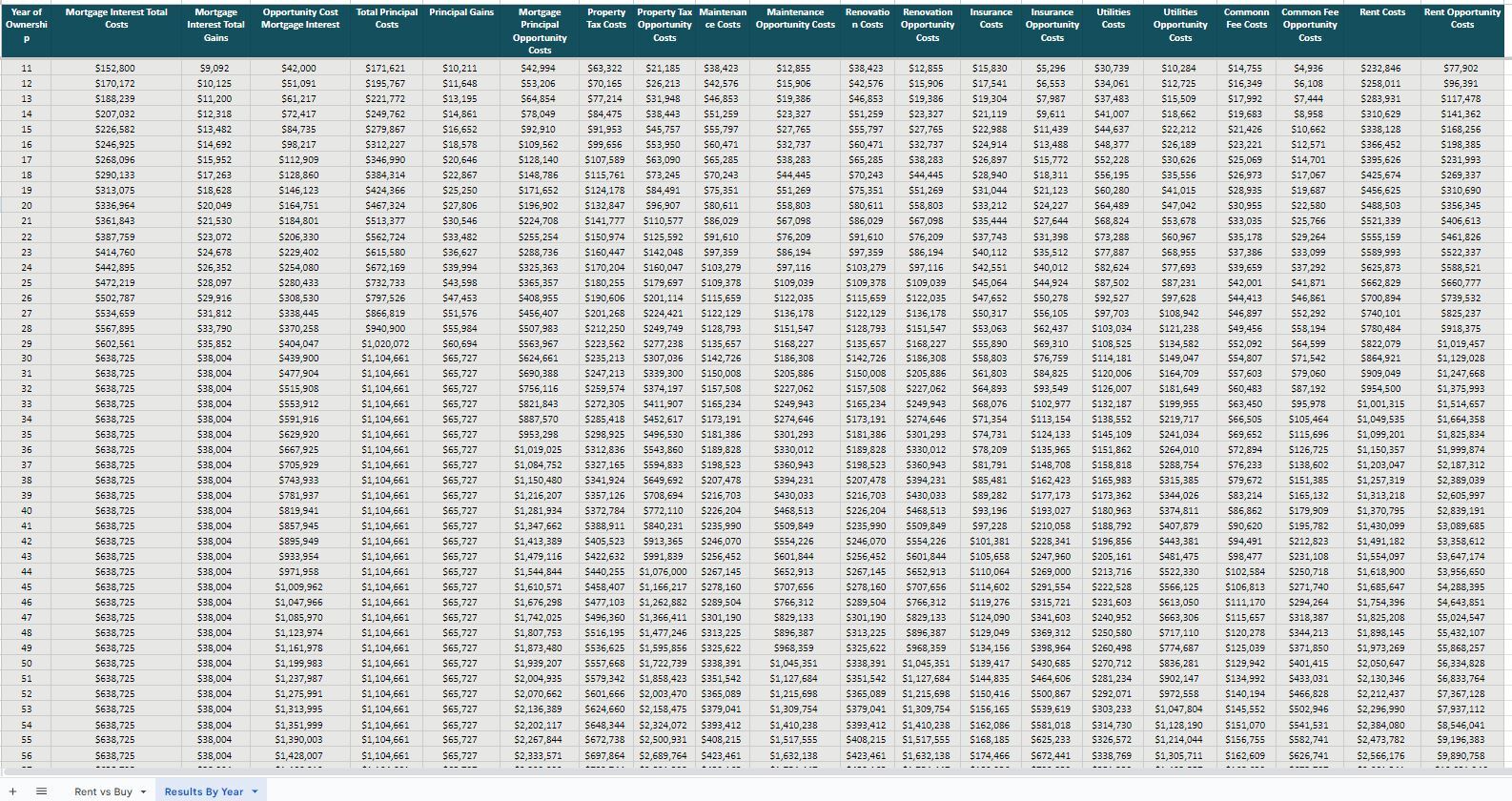

- Review Results: The calculator will generate a detailed breakdown of costs associated with both renting and buying, helping you visualize the financial impact.

Key Features of the Calculator

The New York Times Rent vs Buy Calculator boasts several key features that make it an indispensable tool for anyone weighing their housing options:

- Comprehensive Cost Analysis: Provides a thorough evaluation of all costs involved in both renting and buying.

- Customizable Inputs: Allows users to adjust variables to reflect their specific financial situation.

- Interactive Interface: Offers an easy-to-use platform with clear instructions and visual aids.

- Long-Term Projections: Offers insights into how housing costs may evolve over time, helping users plan for the future.

Benefits of Using the Rent vs Buy Calculator

Using the New York Times Rent vs Buy Calculator offers numerous advantages:

1. Informed Decision-Making

By providing a detailed comparison of costs, the calculator enables users to make decisions based on accurate data rather than assumptions.

2. Financial Clarity

It breaks down complex financial concepts into understandable terms, ensuring users have a clear picture of their options.

3. Flexibility

The calculator accommodates various scenarios, making it suitable for people in different stages of life and financial situations.

Factors to Consider When Using the Calculator

While the New York Times Rent vs Buy Calculator is a valuable tool, there are additional factors to consider when evaluating your housing options:

1. Location

Housing costs can vary significantly depending on the area. Research local market trends to ensure your inputs reflect reality.

2. Economic Conditions

Interest rates, inflation, and economic stability can all impact housing affordability and investment potential.

3. Personal Goals

Consider your long-term objectives, such as family planning or career mobility, when deciding between renting and buying.

Common Mistakes to Avoid

When using the New York Times Rent vs Buy Calculator, it's important to avoid common pitfalls:

- Underestimating Costs: Ensure you account for all potential expenses, including unexpected repairs and maintenance.

- Ignoring Market Trends: Stay informed about housing market conditions to make accurate predictions.

- Overlooking Long-Term Implications: Consider how your decision today might affect your financial situation years down the road.

Renting vs Buying: A Detailed Comparison

The choice between renting and buying involves more than just financial considerations. Here's a closer look at each option:

Advantages of Renting

- Flexibility to move as needed.

- No responsibility for maintenance or repairs.

- Lower upfront costs compared to buying.

Advantages of Buying

- Opportunity for equity building and potential appreciation.

- Greater control over living space and customization.

- Long-term stability and security.

Financial Considerations for Homeownership

Buying a home involves significant financial commitments. Here are some key considerations:

1. Mortgage Payments

Understand the terms of your mortgage, including interest rates and payment schedules.

2. Property Taxes

Factor in annual property taxes, which can vary widely depending on location.

3. Maintenance and Upkeep

Set aside funds for regular maintenance and unexpected repairs to avoid financial strain.

Long-Term Implications of Renting vs Buying

When assessing the long-term implications of renting versus buying, consider the following:

1. Investment Potential

Homeownership can be a valuable investment, providing potential returns through property appreciation.

2. Cost Stability

Renting offers predictable costs, while homeownership may involve fluctuating expenses.

3. Lifestyle Impact

Evaluate how each option aligns with your lifestyle preferences and long-term goals.

Conclusion and Next Steps

In conclusion, the New York Times Rent vs Buy Calculator is an invaluable resource for anyone navigating the complexities of housing decisions. By providing a comprehensive analysis of costs and considerations, it empowers users to make informed choices that align with their financial and personal objectives.

We encourage you to explore the calculator and take advantage of its features to evaluate your options. Don't hesitate to share your thoughts and experiences in the comments section below. Additionally, consider exploring other resources and articles on our site to further enhance your knowledge and decision-making capabilities.

Remember, the path to financial security starts with smart choices. Use the New York Times Rent vs Buy Calculator as your guide, and take the first step toward achieving your housing goals today!

Data sources: The New York Times Rent vs Buy Calculator, Federal Reserve, U.S. Census Bureau.

- Forest Grove Christian Reformed Church

- Can Doordash Drivers See Tip

- Ustaad G76 Indian Cuisine

- Shadow Box With Photos

- Who Is The Quarterback For Texans

New York Times Rent Vs Buy Calculator Eloquens

New York Times Rent Vs Buy Calculator Eloquens

Should You Rent vs. Buy in New York City?