Capital One Sureswipe: Revolutionizing Mobile Payments And Business Growth

Capital One Sureswipe has emerged as a transformative solution for businesses looking to streamline their payment processing capabilities. In today's fast-paced digital world, having a reliable and efficient payment system is essential for business success. This innovative technology offers a seamless way for merchants to accept credit and debit card payments directly from their mobile devices, enhancing both convenience and security.

As the demand for mobile payment solutions continues to grow, Capital One Sureswipe stands out as a leader in the industry. By providing a user-friendly platform with advanced features, it empowers businesses of all sizes to adapt to the evolving needs of consumers. In this article, we will explore the benefits, features, and practical applications of Capital One Sureswipe, helping you understand why it is a valuable asset for modern businesses.

Whether you're a small business owner or a large enterprise looking to upgrade your payment processing system, Capital One Sureswipe offers a comprehensive solution tailored to meet your needs. By integrating cutting-edge technology with exceptional customer service, Capital One ensures that businesses can focus on what matters most: growth and customer satisfaction.

- What Was Weezer S First Album

- Weston Elementary Ripon Ca

- Who Are The Parents Of Thomas Matthew Crooks

- Easy Diy Macrame Wall Hanging

- Why Is Russia Not In The Olympics But Israel Is

Table of Contents

- Introduction to Capital One Sureswipe

- Key Features of Capital One Sureswipe

- Benefits of Using Capital One Sureswipe

- Security Measures in Capital One Sureswipe

- Pricing and Cost Analysis

- Comparison with Other Payment Solutions

- How to Set Up Capital One Sureswipe

- Practical Usage and Applications

- Customer Testimonials and Reviews

- Future of Capital One Sureswipe

Introduction to Capital One Sureswipe

Capital One Sureswipe is a state-of-the-art mobile payment solution designed to meet the needs of businesses in an increasingly digital economy. By enabling merchants to accept card payments through their smartphones or tablets, it eliminates the need for bulky and expensive traditional point-of-sale (POS) systems. This flexibility allows businesses to operate more efficiently, whether they're in a brick-and-mortar store, at a pop-up shop, or even on the go.

Why Choose Capital One Sureswipe?

There are several compelling reasons to consider Capital One Sureswipe for your business needs. Firstly, its ease of use ensures that even those with minimal technical knowledge can quickly adapt to the system. Secondly, its affordability makes it accessible to businesses of all sizes, from startups to established enterprises. Lastly, its robust security features provide peace of mind, ensuring that both merchants and customers are protected during transactions.

With Capital One Sureswipe, businesses can enjoy a seamless payment experience that enhances operational efficiency and customer satisfaction. This solution not only simplifies payment processing but also provides valuable insights into transaction data, helping businesses make informed decisions.

- Is Damon Wayans Jr Married

- Sonic Drive In Frisco Tx

- Can Doordash Drivers See Tip

- When Is Jenni Rivera S Birthday

- Shopping Mall Amarillo Tx

Key Features of Capital One Sureswipe

Capital One Sureswipe offers a wide range of features that cater to the diverse needs of modern businesses. These features are designed to enhance the payment experience for both merchants and customers, ensuring a smooth and secure transaction process.

1. Mobile Payment Flexibility

One of the standout features of Capital One Sureswipe is its ability to process payments through mobile devices. This flexibility allows businesses to accept payments virtually anywhere, whether they're at a physical location or attending an event.

2. Advanced Security Protocols

Capital One Sureswipe employs cutting-edge security measures, including encryption and tokenization, to protect sensitive payment information. This ensures that both merchants and customers can transact with confidence.

3. Real-Time Transaction Processing

With Capital One Sureswipe, businesses can enjoy real-time transaction processing, reducing delays and improving cash flow management. This feature is particularly beneficial for businesses that rely on timely payments to sustain their operations.

Benefits of Using Capital One Sureswipe

Implementing Capital One Sureswipe into your business operations can yield numerous benefits. From increased efficiency to enhanced customer satisfaction, this solution offers a comprehensive approach to payment processing.

1. Cost-Effective Solution

Capital One Sureswipe eliminates the need for expensive POS systems, making it a cost-effective option for businesses. Its pay-as-you-go pricing model ensures that businesses only pay for the services they use, reducing unnecessary expenses.

2. Improved Customer Experience

By offering a seamless payment experience, Capital One Sureswipe helps businesses improve customer satisfaction. Faster transaction times and secure payment processing contribute to a positive customer experience, encouraging repeat business.

3. Enhanced Data Insights

Capital One Sureswipe provides valuable insights into transaction data, helping businesses make informed decisions. This data can be used to optimize operations, identify trends, and develop targeted marketing strategies.

Security Measures in Capital One Sureswipe

Security is a top priority for Capital One Sureswipe, and the platform employs several measures to protect sensitive payment information. These measures include:

- End-to-end encryption to safeguard data during transmission

- Tokenization to replace sensitive card data with unique identifiers

- Compliance with industry standards such as PCI DSS

These security protocols ensure that both merchants and customers can transact with confidence, knowing that their payment information is protected.

Pricing and Cost Analysis

Capital One Sureswipe offers a transparent and flexible pricing model that caters to businesses of all sizes. The platform charges a per-transaction fee, with no hidden costs or long-term contracts. This pay-as-you-go model allows businesses to scale their operations without worrying about unexpected expenses.

1. Competitive Transaction Fees

Capital One Sureswipe offers competitive transaction fees that are lower than many traditional payment processors. This makes it an attractive option for businesses looking to reduce their payment processing costs.

2. No Setup or Maintenance Fees

Unlike many payment solutions, Capital One Sureswipe does not charge setup or maintenance fees. This further reduces the overall cost of implementing the platform, making it more accessible to businesses of all sizes.

Comparison with Other Payment Solutions

When evaluating payment solutions, it's important to consider the features, pricing, and security offered by each platform. Capital One Sureswipe stands out in several key areas:

1. Superior Security

Capital One Sureswipe's advanced security measures set it apart from many competitors, providing peace of mind for both merchants and customers.

2. Flexible Pricing

With its pay-as-you-go pricing model, Capital One Sureswipe offers greater flexibility than many traditional payment processors, which often require long-term contracts.

3. User-Friendly Interface

Capital One Sureswipe's intuitive interface makes it easy for businesses to adopt the platform, even if they have limited technical expertise.

How to Set Up Capital One Sureswipe

Setting up Capital One Sureswipe is a straightforward process that can be completed in just a few steps:

- Create an account on the Capital One Sureswipe website

- Download the Sureswipe app to your mobile device

- Connect your mobile device to the Sureswipe card reader

- Start accepting payments immediately

This simple setup process ensures that businesses can begin using Capital One Sureswipe quickly and efficiently, without the need for extensive training or technical support.

Practical Usage and Applications

Capital One Sureswipe can be used in a variety of settings, making it a versatile solution for businesses across industries. Some common use cases include:

- Retail stores looking to streamline their payment processing

- Mobile vendors needing a portable payment solution

- Service providers requiring on-the-go payment capabilities

By offering a flexible and reliable payment solution, Capital One Sureswipe helps businesses adapt to the changing demands of the modern marketplace.

Customer Testimonials and Reviews

Capital One Sureswipe has received positive feedback from businesses across industries, highlighting its ease of use, affordability, and security. Some notable testimonials include:

- "Capital One Sureswipe has transformed the way we process payments, making it easier and more secure for both us and our customers." - John D., Retail Store Owner

- "The flexibility of Capital One Sureswipe has allowed us to expand our business and reach new customers." - Sarah L., Mobile Vendor

These testimonials underscore the value that Capital One Sureswipe brings to businesses of all sizes.

Future of Capital One Sureswipe

As the demand for mobile payment solutions continues to grow, Capital One Sureswipe is poised to play a significant role in shaping the future of payment processing. With ongoing innovations and enhancements, the platform is well-positioned to meet the evolving needs of businesses and consumers alike.

In the coming years, Capital One Sureswipe is expected to expand its feature set, improve its user interface, and enhance its security protocols. These developments will further solidify its position as a leader in the mobile payment industry.

Kesimpulan

Capital One Sureswipe offers a comprehensive and innovative solution for businesses looking to streamline their payment processing capabilities. With its advanced features, competitive pricing, and robust security measures, it provides a valuable asset for businesses of all sizes.

We encourage you to explore Capital One Sureswipe and discover how it can benefit your business. Don't forget to leave a comment or share this article with others who may find it useful. For more insights into payment solutions and business growth strategies, be sure to check out our other articles on the site.

References:

- Capital One Official Website

- Payment Processing Industry Reports

- Customer Testimonials and Reviews

- Smallest Tank In The World

- Rack Room Shoes Cary Nc

- When Was Steven Tyler Born

- Gkn Bowling Green Ohio

- Sonic Drive In Clovis

Club Capital Business

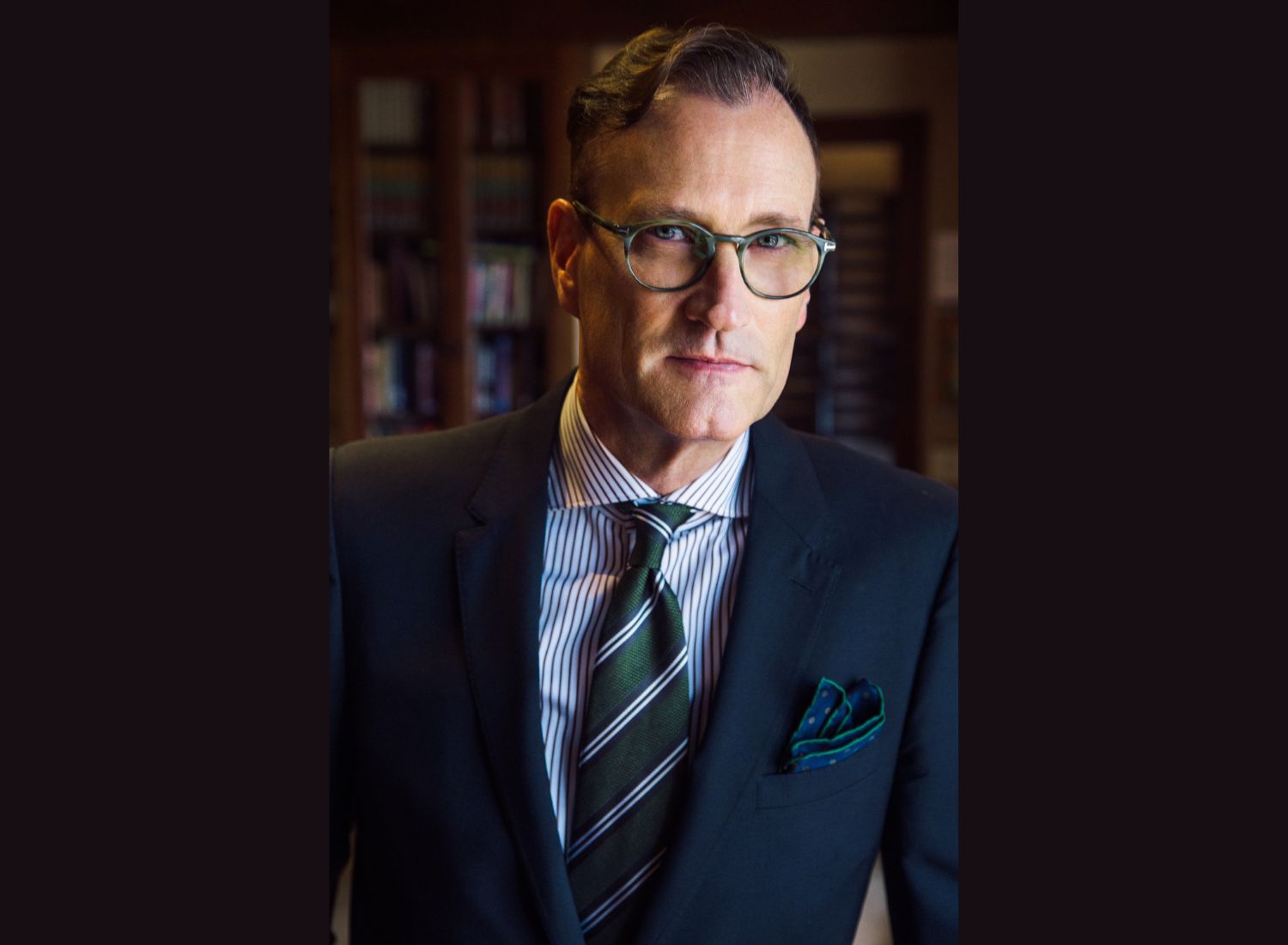

Spotlight On Eyal Lifshitz, Founder & CEO, Bluevine

Spotlight On Novice, President & CEO, Broadway Dallas