TurboTax $100 Back: A Comprehensive Guide To Maximizing Your Tax Refunds

Are you looking for ways to maximize your tax refund this year? TurboTax's $100 Back program offers a fantastic opportunity to get more money back while ensuring your taxes are filed accurately and efficiently. Whether you're a seasoned taxpayer or new to the process, understanding how TurboTax $100 Back works can help you save time and money.

Taxes can be overwhelming, especially when navigating complex forms and deductions. TurboTax simplifies the process with its user-friendly software and customer support. The $100 Back offer is just one of the many incentives TurboTax provides to make tax filing easier and more rewarding for users.

In this article, we'll explore everything you need to know about TurboTax $100 Back, including eligibility requirements, how the program works, and tips for maximizing your refund. Let’s dive in!

- When Was Steven Tyler Born

- B R Auto Wrecking Chehalis

- Mr Freeze Six Flags

- Forest Grove Christian Reformed Church

- You Don T Know What You Don T Know Quote

Table of Contents

- Introduction to TurboTax $100 Back

- Who Is Eligible for TurboTax $100 Back?

- How Does TurboTax $100 Back Work?

- Benefits of Using TurboTax for Tax Filing

- Common Questions About TurboTax $100 Back

- Maximizing Tax Deductions with TurboTax

- TurboTax vs. Other Tax Software

- Why Choose TurboTax for Your Taxes?

- Tips for Maximizing Your Tax Refund

- Conclusion: Take Advantage of TurboTax $100 Back

Introduction to TurboTax $100 Back

TurboTax $100 Back is a program designed to reward users who file their taxes through TurboTax and receive a federal tax refund. This initiative reflects TurboTax's commitment to helping taxpayers save money while ensuring their returns are accurate and compliant with IRS regulations.

By participating in the $100 Back program, taxpayers can earn cash back simply by using TurboTax to file their taxes. This program is especially beneficial for those who qualify for significant refunds, as it adds extra value to the tax filing process.

TurboTax offers various packages tailored to different taxpayer needs, from free basic filing to premium services that include state tax filing and expert advice. The $100 Back program is available across most of these packages, making it accessible to a wide range of users.

- Spirit Airlines Rat On Plane

- Carimar Beach Club Hotel Anguilla

- Victoria And Albert Museum Gift Shop

- Yorba Linda Adventure Playground

- Sonic Drive In Frisco Tx

Who Is Eligible for TurboTax $100 Back?

Understanding Eligibility Requirements

To qualify for TurboTax $100 Back, users must meet specific criteria. Below are the key requirements:

- File your federal tax return using TurboTax software or online services.

- Receive a federal tax refund for the current tax year.

- Complete the entire tax filing process through TurboTax, including e-filing your return.

- Ensure your refund is deposited into a U.S.-based bank account.

It’s important to note that TurboTax $100 Back applies only to federal tax refunds and not state refunds. Additionally, the program is subject to certain exclusions and limitations, so it’s advisable to review the official terms and conditions before participating.

How Does TurboTax $100 Back Work?

Step-by-Step Guide to Participating in the Program

Participating in TurboTax $100 Back is straightforward. Follow these steps to take advantage of the program:

- Sign up for a TurboTax account and select the appropriate package for your tax needs.

- Complete your tax return using TurboTax’s guided interview process, which simplifies data entry and ensures accuracy.

- E-file your federal tax return through TurboTax.

- Wait for your federal tax refund to be deposited into your bank account.

- Once your refund is received, TurboTax will automatically process your $100 cash back reward.

Users typically receive their $100 Back reward within 30 days of receiving their federal tax refund. The reward is deposited directly into the same bank account where the refund was sent, eliminating the need for additional steps.

Benefits of Using TurboTax for Tax Filing

Why TurboTax Stands Out

TurboTax offers numerous advantages beyond the $100 Back program. Here are some key benefits:

- User-Friendly Interface: TurboTax’s intuitive design makes tax filing accessible even for those with limited tax knowledge.

- Comprehensive Deduction Finder: The software helps identify potential deductions and credits you might not be aware of, increasing your refund.

- Live Expert Support: Access to certified tax professionals ensures you get accurate answers to your tax questions.

- Security Features: TurboTax employs robust encryption and security measures to protect your sensitive financial information.

These features, combined with the $100 Back program, make TurboTax a top choice for taxpayers seeking convenience and value.

Common Questions About TurboTax $100 Back

Answers to Frequently Asked Questions

Here are answers to some common questions about TurboTax $100 Back:

- Q: Can I use TurboTax $100 Back if I file a state tax return?

- Q: Is there a limit to how many times I can claim the $100 Back reward?

- Q: What happens if my refund is adjusted after filing?

A: Yes, you can still participate in the program even if you file a state return, but the $100 Back reward is based solely on your federal tax refund.

A: Each taxpayer is eligible for one $100 Back reward per tax season, based on their federal tax refund.

A: If your refund amount changes due to an IRS adjustment, TurboTax will reassess your eligibility for the $100 Back reward accordingly.

Maximizing Tax Deductions with TurboTax

Strategies for Boosting Your Refund

TurboTax’s deduction finder tool is a powerful resource for uncovering potential tax breaks. Some common deductions to consider include:

- Standard Deduction vs. Itemized Deduction

- Home Office Deduction

- Charitable Contributions

- Student Loan Interest

- Healthcare Expenses

By leveraging TurboTax’s tools and resources, you can ensure you’re claiming all eligible deductions and credits, maximizing your refund potential.

TurboTax vs. Other Tax Software

Why TurboTax Is the Best Choice

While there are several tax software options available, TurboTax stands out for several reasons:

- Feature-Rich Packages: TurboTax offers a range of packages to suit different taxpayer needs, from basic to premium services.

- Customer Support: TurboTax provides live support from certified tax professionals, giving users peace of mind during the filing process.

- Value-Added Programs: Initiatives like TurboTax $100 Back and the Free Edition make TurboTax an attractive option for taxpayers of all income levels.

Comparing TurboTax to competitors like H&R Block and TaxAct reveals that TurboTax consistently delivers superior user experience and value.

Why Choose TurboTax for Your Taxes?

Establishing Trust and Authority

TurboTax has been a trusted name in tax preparation for over 40 years. Its commitment to innovation, accuracy, and customer satisfaction has earned it a reputation as a leader in the industry. Key factors contributing to TurboTax’s authority include:

- Proven Track Record: Millions of users rely on TurboTax each year to file their taxes confidently.

- Expertise in Tax Law: TurboTax’s software is regularly updated to reflect changes in tax laws, ensuring compliance and accuracy.

- Customer-Centric Approach: TurboTax prioritizes user experience, offering tools and resources to make tax filing as seamless as possible.

These qualities make TurboTax a reliable choice for taxpayers seeking efficient and effective tax solutions.

Tips for Maximizing Your Tax Refund

Practical Advice for Getting More Back

To make the most of TurboTax $100 Back and other tax incentives, consider the following tips:

- Start Early: Begin gathering your tax documents early in the year to avoid last-minute stress.

- Review Deductions and Credits: Take time to explore all possible deductions and credits you may qualify for.

- Use TurboTax’s Tools: Leverage TurboTax’s deduction finder and other features to optimize your refund.

- Stay Informed: Keep up with changes in tax laws that may impact your filing strategy.

By following these tips, you can enhance your chances of receiving a larger refund and fully benefiting from TurboTax $100 Back.

Conclusion: Take Advantage of TurboTax $100 Back

TurboTax $100 Back is an excellent opportunity for taxpayers to earn extra cash while ensuring their taxes are filed accurately and efficiently. By meeting eligibility requirements and following the program guidelines, you can enjoy the benefits of this rewarding initiative.

Remember to take full advantage of TurboTax’s features and resources to maximize your refund. Whether you’re a first-time user or a long-time customer, TurboTax offers the tools and support you need to succeed during tax season.

We encourage you to share your thoughts and experiences with TurboTax $100 Back in the comments below. Additionally, explore other articles on our site for more insights into personal finance and tax planning. Together, let’s make tax season a stress-free and rewarding experience!

Sources:

- Father Of The Daughter Wedding Speech

- Ustaad G76 Indian Cuisine

- Ross For Less Houston

- Washington Nat Prem Debit

- How To Keep An Apple Fresh After Cutting It

Get 100 Back Instantly When You File Your Taxes With TurboTax Full

Get 100 Back Instantly When You File Your Taxes With TurboTax Full

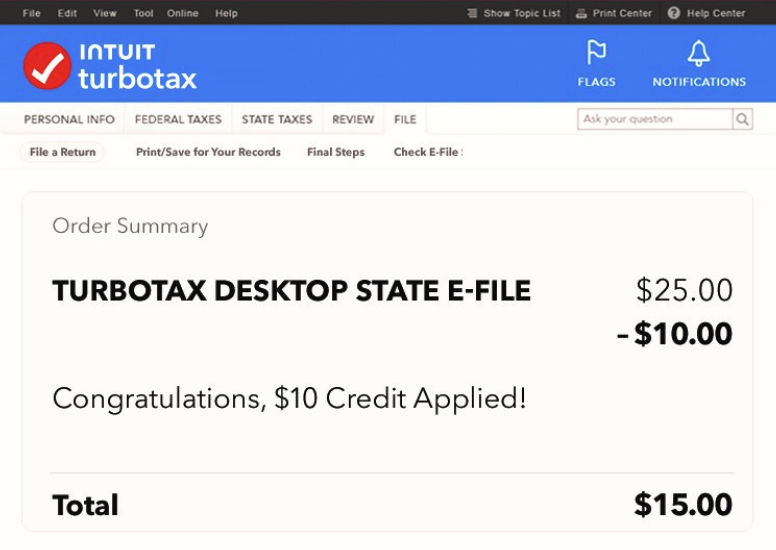

What is the TurboTax Desktop 10 credit available at wholesale clubs?