1st Gateway Credit Union Iowa: Your Trusted Financial Partner

1st Gateway Credit Union Iowa has become a cornerstone of financial services in the state, offering members unparalleled benefits, personalized solutions, and a commitment to community growth. Whether you're looking for competitive loan rates, high-yield savings accounts, or expert financial advice, this credit union stands out as a reliable choice for individuals and families. In this article, we will explore everything you need to know about 1st Gateway Credit Union Iowa, its offerings, and why it deserves your trust.

Financial institutions play a vital role in shaping the economic well-being of individuals and communities. Credit unions, in particular, are member-owned cooperatives designed to prioritize the needs of their members over profit. Among the many credit unions available, 1st Gateway Credit Union Iowa has emerged as a leader in providing exceptional financial services while fostering strong relationships with its members.

This article aims to provide an in-depth overview of 1st Gateway Credit Union Iowa, its history, services, and the benefits it offers. By the end of this article, you'll have a comprehensive understanding of why this credit union is worth considering for your financial needs.

- Are Carp And Koi The Same

- Spirit Airlines Rat On Plane

- Gilroy Gardens North Pole Nights

- Gkn Bowling Green Ohio

- You Don T Know What You Don T Know Quote

Table of Contents

- The History of 1st Gateway Credit Union Iowa

- Who Can Join 1st Gateway Credit Union Iowa?

- Comprehensive Financial Services

- Loan Options for Every Need

- Savings Accounts Tailored to Your Goals

- Enhanced Digital Banking Experience

- Community Involvement and Impact

- Security Measures to Protect Your Assets

- Why Choose 1st Gateway Credit Union Iowa?

- The Future of 1st Gateway Credit Union Iowa

The History of 1st Gateway Credit Union Iowa

1st Gateway Credit Union Iowa was established with a mission to empower its members through accessible and affordable financial services. Founded in [Year], the credit union has grown from a small group of dedicated individuals to a thriving institution serving thousands of members across Iowa. Its commitment to integrity, transparency, and member satisfaction has been the driving force behind its success.

Over the years, 1st Gateway Credit Union Iowa has expanded its offerings, embraced technological advancements, and maintained a strong focus on community development. This section explores the milestones that have shaped the credit union's journey and highlights its evolution into a trusted financial partner.

Key Milestones in the Credit Union's History

- Established in [Year] with a focus on serving local communities.

- Introduced online banking services in [Year], enhancing accessibility for members.

- Expanded its service area to include additional counties in Iowa.

- Launched mobile banking apps to provide convenience for on-the-go members.

Who Can Join 1st Gateway Credit Union Iowa?

Membership in 1st Gateway Credit Union Iowa is open to individuals who meet specific eligibility criteria. Unlike traditional banks, credit unions operate as member-owned cooperatives, meaning that members share a common bond. For 1st Gateway Credit Union Iowa, this common bond typically includes residing, working, or worshiping within the credit union's service area in Iowa.

- How To Use Piping Bags

- Beauty And Essex Reviews

- Iris Goo Goo Dolls Cover

- Www Saudi Arabian Airlines

- When Was Steven Tyler Born

Additionally, individuals affiliated with certain organizations or employers may qualify for membership. To join, applicants must open a share account with a minimum deposit, which also serves as their membership fee. This section outlines the eligibility requirements and the benefits of becoming a member.

Eligibility Requirements

- Reside, work, or worship in the credit union's service area.

- Be affiliated with eligible organizations or employers.

- Open a share account with a minimum deposit.

Comprehensive Financial Services

1st Gateway Credit Union Iowa offers a wide range of financial products and services designed to meet the diverse needs of its members. From checking accounts to investment opportunities, the credit union provides solutions that cater to both personal and business financial requirements. This section highlights the core services offered by the credit union and explains how they benefit members.

Types of Accounts

- Checking accounts with no hidden fees.

- Savings accounts with competitive interest rates.

- Money market accounts for higher balances.

Loan Options for Every Need

One of the standout features of 1st Gateway Credit Union Iowa is its extensive selection of loan options. Whether you're purchasing a home, financing a vehicle, or consolidating debt, the credit union offers competitive rates and flexible terms. Members can enjoy personalized loan solutions tailored to their specific needs.

This section delves into the various loan products available, including mortgages, auto loans, personal loans, and more. It also highlights the benefits of borrowing from a credit union, such as lower interest rates and reduced fees compared to traditional banks.

Popular Loan Products

- Mortgage loans with competitive rates and terms.

- Auto loans for new and used vehicles.

- Personal loans for debt consolidation or other expenses.

Savings Accounts Tailored to Your Goals

Saving money is an essential aspect of financial planning, and 1st Gateway Credit Union Iowa offers a variety of savings accounts to help members achieve their goals. From traditional savings accounts to certificates of deposit (CDs), the credit union provides options that cater to different saving preferences and timelines.

This section explains the features and benefits of each savings account type, helping members choose the one that aligns with their financial objectives.

Features of Savings Accounts

- No minimum balance requirements for basic savings accounts.

- Competitive interest rates on CDs.

- Easy access to funds through online banking.

Enhanced Digital Banking Experience

In today's digital age, convenience is key. 1st Gateway Credit Union Iowa understands this and has invested in cutting-edge technology to provide members with a seamless digital banking experience. From mobile banking apps to online bill pay, the credit union ensures that members can manage their finances effortlessly from anywhere.

This section explores the digital tools and resources available to members, emphasizing the security measures in place to protect sensitive information.

Benefits of Digital Banking

- Access your accounts 24/7 through mobile apps.

- Pay bills and transfer funds securely online.

- Receive real-time notifications for account activity.

Community Involvement and Impact

1st Gateway Credit Union Iowa is deeply committed to giving back to the communities it serves. Through charitable contributions, volunteer work, and educational programs, the credit union strives to make a positive impact on the lives of its members and the surrounding areas. This section highlights the credit union's community involvement efforts and the difference it makes in Iowa.

Data from the Federal Reserve indicates that credit unions contribute significantly to local economies by reinvesting profits into member services and community initiatives. 1st Gateway Credit Union Iowa exemplifies this commitment through its ongoing support of local schools, nonprofits, and community events.

Security Measures to Protect Your Assets

Security is a top priority for 1st Gateway Credit Union Iowa. The credit union employs advanced encryption technology and fraud detection systems to safeguard members' financial information. Additionally, it adheres to strict regulatory standards to ensure compliance and protect against cyber threats.

This section outlines the security measures in place and provides tips for members to enhance their own account safety.

Security Features

- Two-factor authentication for online access.

- Real-time fraud monitoring for suspicious activity.

- Regular security updates to protect against evolving threats.

Why Choose 1st Gateway Credit Union Iowa?

1st Gateway Credit Union Iowa stands out from traditional banks due to its member-centric approach and commitment to delivering exceptional service. Members benefit from lower fees, higher interest rates on savings, and personalized financial advice. Additionally, the credit union's focus on community development and financial education sets it apart as a trusted partner for individuals and families.

According to a report by the National Credit Union Administration (NCUA), credit unions consistently outperform banks in member satisfaction and service quality. This section summarizes the key reasons why 1st Gateway Credit Union Iowa is a superior choice for your financial needs.

The Future of 1st Gateway Credit Union Iowa

As technology continues to evolve, 1st Gateway Credit Union Iowa remains committed to innovation and improvement. The credit union plans to expand its digital offerings, enhance member services, and deepen its involvement in community development. By staying ahead of industry trends, 1st Gateway Credit Union Iowa aims to continue serving as a leader in financial services for years to come.

Upcoming Initiatives

- Introduction of new mobile banking features.

- Expansion of community outreach programs.

- Investment in financial literacy education.

Kesimpulan

1st Gateway Credit Union Iowa has established itself as a reliable and member-focused financial institution, offering a wide array of services tailored to meet the needs of individuals and families across Iowa. From competitive loan rates and high-yield savings accounts to advanced digital banking solutions, the credit union provides everything members need to achieve their financial goals.

We encourage you to explore the benefits of joining 1st Gateway Credit Union Iowa and take advantage of the exceptional services it offers. Don't forget to share this article with others who may benefit from learning about this trusted financial partner. For more information, visit the credit union's official website or contact them directly to speak with a representative.

- Victoria And Albert Museum Gift Shop

- When Was Steven Tyler Born

- The Wild Robot Gross

- Yorba Linda Adventure Playground

- Ross For Less Houston

Gateway Credit Union logo. new Gateway Assembly

1ST Gateway Credit Union Celebrates 70 years

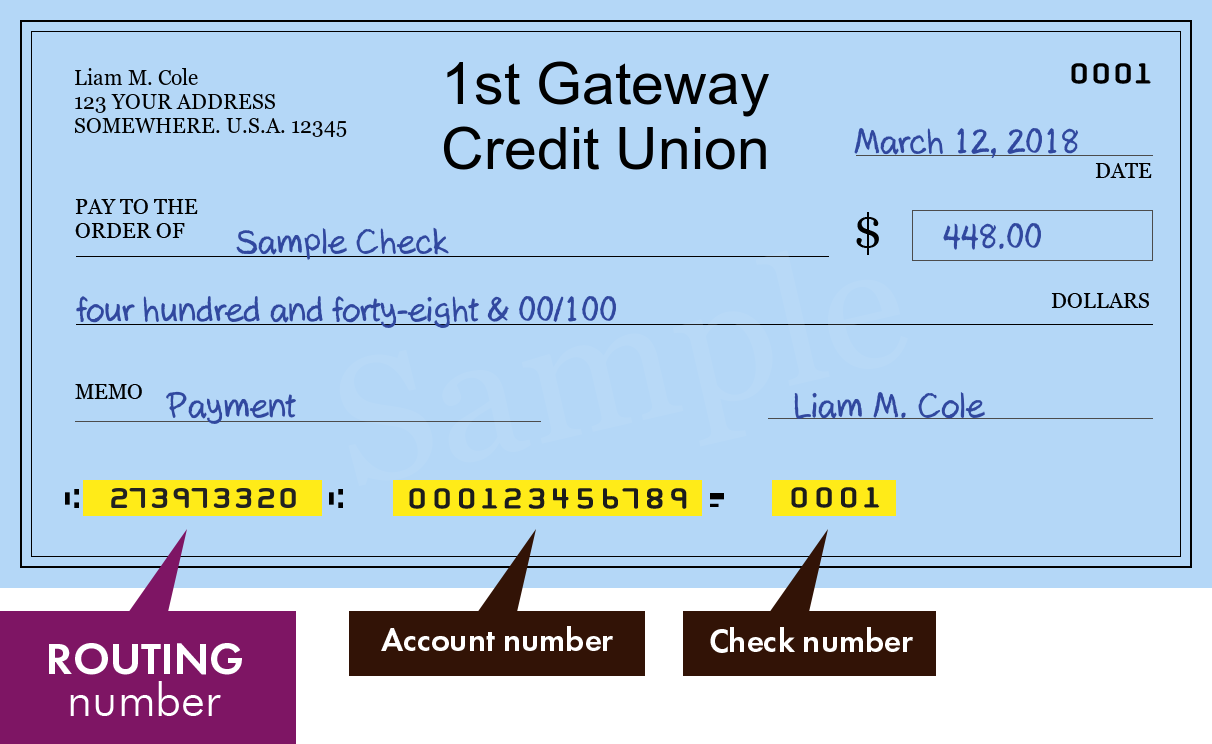

1st Gateway Credit Union search routing numbers, addresses and phones