Bullion Trading In New York: A Comprehensive Guide To Unlocking Opportunities

Bullion trading in New York has become a cornerstone of the global financial market, offering investors a reliable avenue for wealth preservation and growth. As one of the world's leading financial hubs, New York provides an ideal environment for individuals and businesses looking to engage in precious metals trading. Whether you're a seasoned trader or a newcomer to the world of bullion, understanding the nuances of this market can significantly enhance your investment strategy.

New York's prominence in bullion trading stems from its strategic location and robust infrastructure. The city houses some of the largest financial institutions and exchanges, making it a natural choice for those seeking to trade gold, silver, platinum, and palladium. Investors are drawn to bullion trading due to its potential for long-term value appreciation and its role as a hedge against inflation and economic uncertainty.

As the global economy continues to evolve, bullion trading in New York remains a critical component of diversified portfolios. This article will delve into the intricacies of this market, providing you with actionable insights and expert advice to help you navigate the complexities of precious metals trading. From understanding the basics to exploring advanced strategies, this guide is designed to empower you with the knowledge needed to succeed in this dynamic field.

- Ross For Less Houston

- I Came From A Middle Class Family

- Iris Goo Goo Dolls Cover

- How To Keep An Apple Fresh After Cutting It

- Mr Freeze Six Flags

Table of Contents

- Introduction to Bullion Trading

- Why New York is a Hub for Bullion Trading

- Types of Bullion Available for Trading

- Market Structure and Participants

- Benefits of Engaging in Bullion Trading

- Risks and Challenges in Bullion Trading

- Regulatory Framework in New York

- Getting Started with Bullion Trading

- Strategies for Success in Bullion Trading

- Future Trends in Bullion Trading

Introduction to Bullion Trading

Bullion trading refers to the buying and selling of precious metals in the form of bars, coins, or ingots. These metals, primarily gold, silver, platinum, and palladium, are considered valuable assets due to their rarity and inherent worth. Investors engage in bullion trading for various reasons, including diversification, inflation hedging, and capital appreciation.

Understanding the Basics

To succeed in bullion trading, it is essential to grasp the fundamental concepts. This includes understanding the different types of bullion, market dynamics, and the factors influencing price movements. For instance, geopolitical events, currency fluctuations, and supply-demand imbalances can significantly impact the value of precious metals.

Key Players in the Market

Bullion trading involves a variety of participants, ranging from individual investors to large financial institutions. Banks, brokerage firms, and specialized dealers play crucial roles in facilitating transactions and ensuring market liquidity. Understanding the roles of these players can help traders make informed decisions.

- Michigan Works Benton Harbor Mi

- What Was Weezer S First Album

- Yorba Linda Adventure Playground

- Alamance Crossing Burlington Nc

- The Lodge At Whitehawk Ranch

Why New York is a Hub for Bullion Trading

New York's prominence in bullion trading can be attributed to several factors. As the home of the New York Mercantile Exchange (NYMEX) and the Commodity Futures Trading Commission (CFTC), the city offers a well-regulated environment conducive to financial activities. Additionally, New York's extensive network of financial institutions and trading platforms makes it an ideal location for executing large-scale transactions.

Advantages of Trading in New York

- Access to global markets

- Strong regulatory framework

- Advanced trading infrastructure

- High liquidity and market depth

Types of Bullion Available for Trading

The bullion market offers a variety of precious metals for trading. Each metal has unique characteristics and applications, influencing its demand and price. Below is an overview of the most commonly traded bullion types:

Gold

Gold remains the most popular precious metal for investment purposes. Its enduring value and widespread acceptance make it an attractive asset for traders worldwide.

Silver

Silver, often referred to as "poor man's gold," is valued for its affordability and industrial applications. It serves as an excellent entry point for novice traders looking to explore bullion trading.

Platinum and Palladium

Platinum and palladium are less commonly traded than gold and silver but offer significant potential for profit due to their specialized uses in automotive and industrial sectors.

Market Structure and Participants

The bullion trading market in New York operates through a well-defined structure involving multiple participants. These include:

- Exchange platforms

- Brokerage firms

- Hedgers and speculators

- Institutional investors

Each participant plays a vital role in maintaining market efficiency and ensuring fair pricing.

Benefits of Engaging in Bullion Trading

Bullion trading offers numerous advantages to investors, including:

Diversification

Precious metals provide a hedge against stock market volatility, reducing overall portfolio risk.

Inflation Protection

Bullion acts as a store of value, preserving wealth during periods of inflation.

Capital Appreciation

Historically, precious metals have demonstrated strong price appreciation over the long term.

Risks and Challenges in Bullion Trading

While bullion trading offers significant opportunities, it also comes with inherent risks. These include:

- Price volatility

- Counterparty risk

- Regulatory changes

- Storage and security concerns

Understanding these risks is crucial for developing effective risk management strategies.

Regulatory Framework in New York

New York's bullion trading market is governed by stringent regulations designed to protect investors and ensure market integrity. Key regulatory bodies include:

- Commodity Futures Trading Commission (CFTC)

- Securities and Exchange Commission (SEC)

- Financial Industry Regulatory Authority (FINRA)

These organizations oversee trading activities, enforce compliance, and investigate fraudulent practices.

Getting Started with Bullion Trading

Embarking on a bullion trading journey requires careful preparation and planning. Below are some steps to help you get started:

Step 1: Educate Yourself

Gain a thorough understanding of the bullion market through research and analysis.

Step 2: Choose a Reputable Broker

Select a licensed broker offering competitive pricing and reliable customer support.

Step 3: Develop a Trading Plan

Create a comprehensive trading plan outlining your objectives, risk tolerance, and investment strategies.

Strategies for Success in Bullion Trading

Successful bullion trading requires a combination of knowledge, discipline, and strategy. Below are some proven strategies to enhance your trading performance:

- Adopt a long-term investment approach

- Utilize technical and fundamental analysis

- Practice effective risk management

- Stay updated with market trends and news

Future Trends in Bullion Trading

The bullion trading landscape is continually evolving, driven by technological advancements and changing market dynamics. Key trends to watch include:

Increased Use of Digital Platforms

Online trading platforms are becoming increasingly popular, offering traders greater accessibility and convenience.

Emergence of Cryptocurrencies

The rise of digital currencies is influencing the precious metals market, with some investors exploring hybrid investment opportunities.

Sustainability and Ethical Sourcing

There is growing demand for sustainably sourced bullion, reflecting a broader shift towards responsible investing practices.

Conclusion

Bullion trading in New York presents a wealth of opportunities for investors seeking to diversify their portfolios and preserve wealth. By understanding the market dynamics, regulatory framework, and potential risks, you can position yourself for success in this dynamic field. We encourage you to share your thoughts and experiences in the comments section below and explore other informative articles on our website. Together, let's unlock the full potential of bullion trading!

- When Was Steven Tyler Born

- Wall To Wall New York

- Hca Florida Mercy Hospital Emergency Room

- Lilly Sabri Free Workout Plan

- Pizza Brew Scarsdale

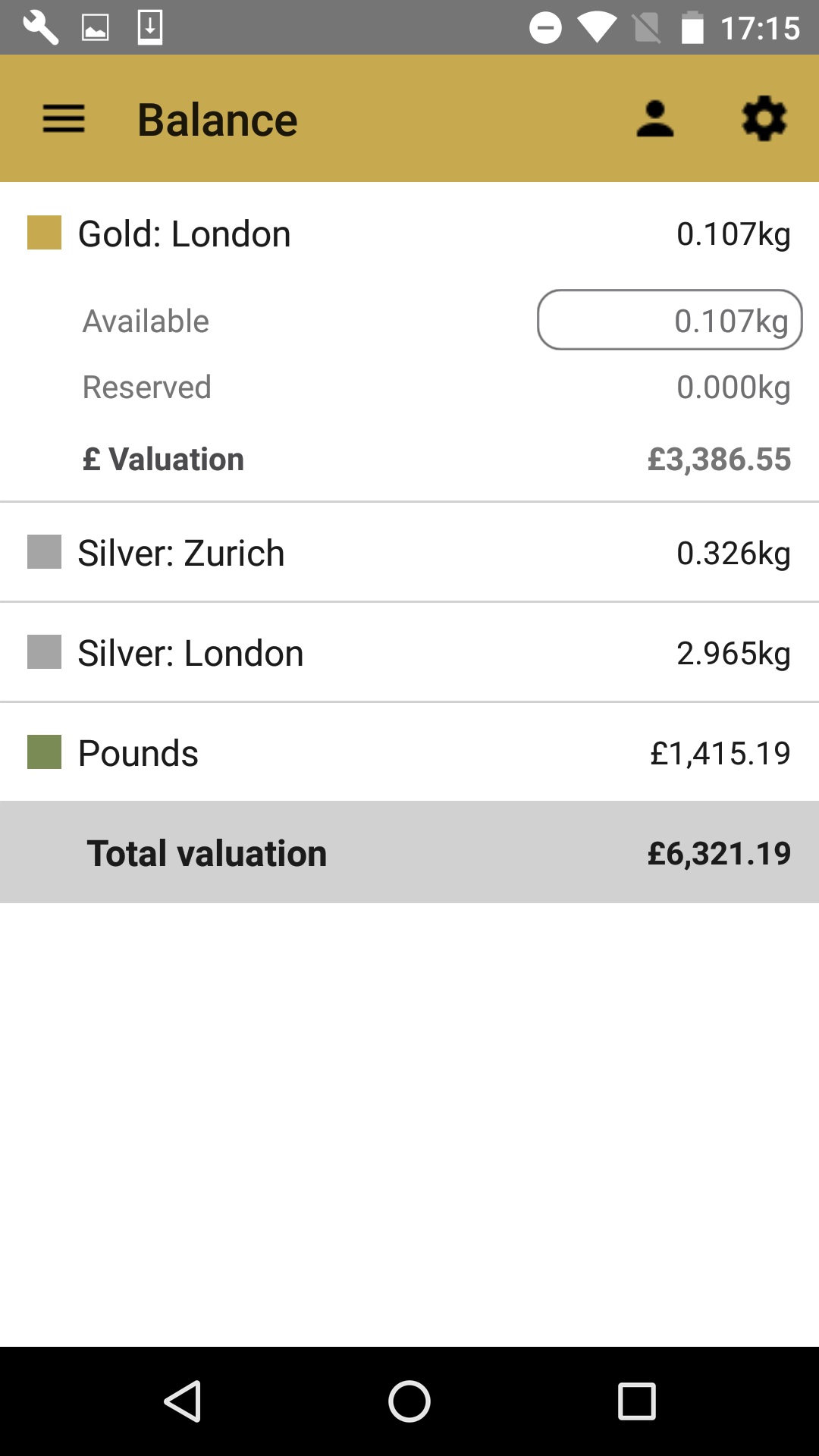

Mobile Bullion Trading App Trade Gold and Silver on the Move

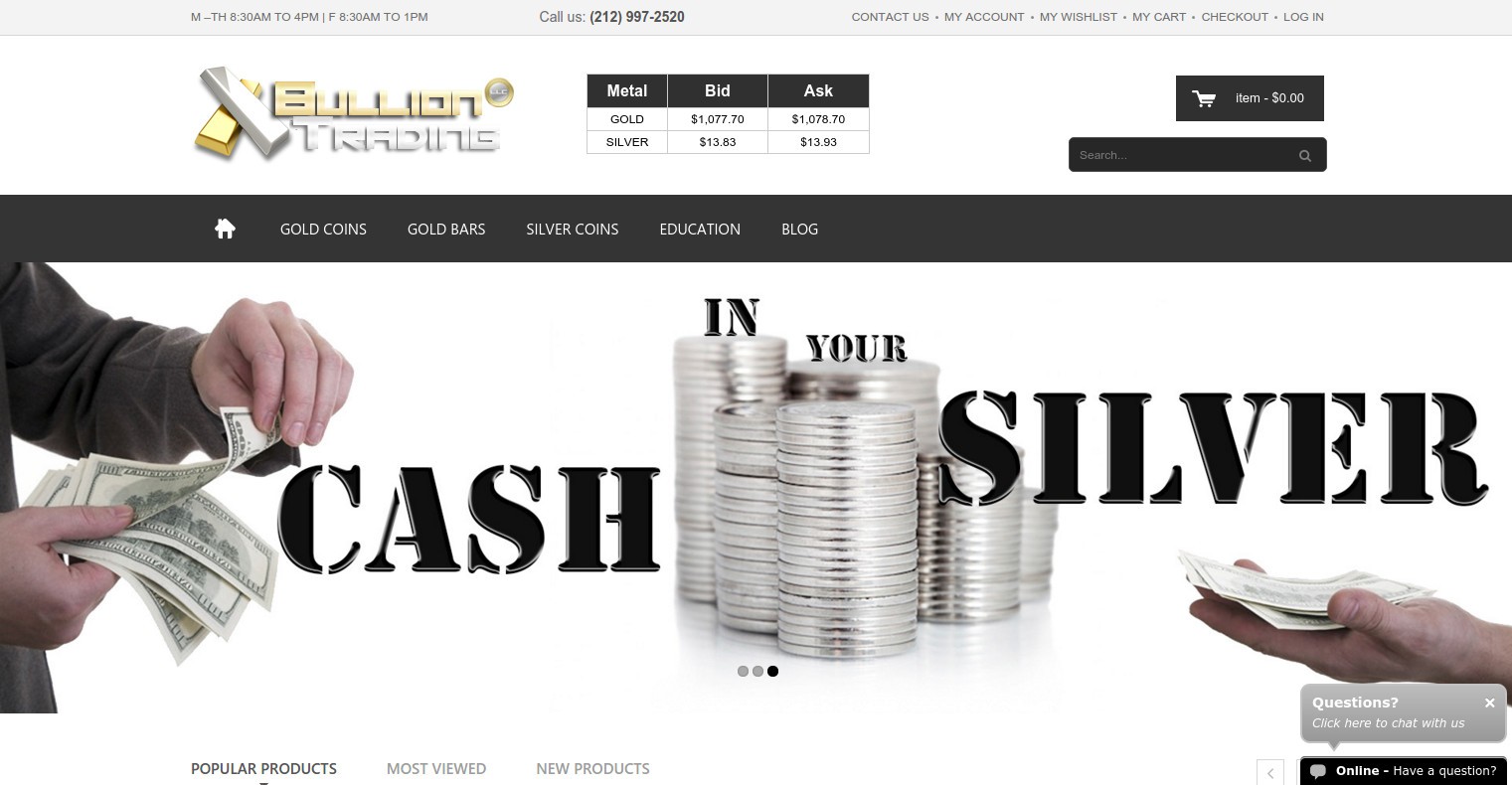

Bullion Trading LLC New York, New York Coin Dealer Reviews

Bullion Trading LLC New York, New York Coin Dealer Reviews